|

|

|

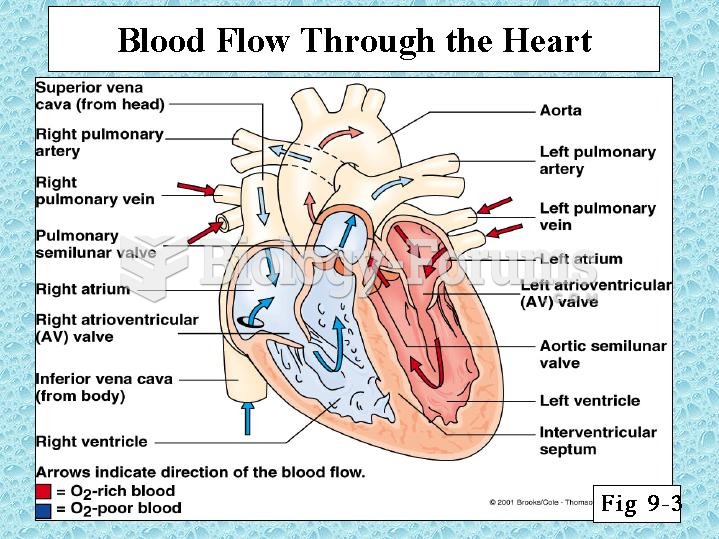

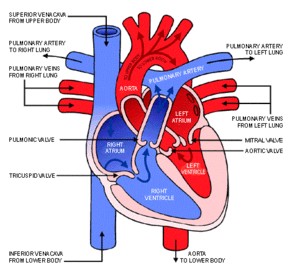

It is widely believed that giving a daily oral dose of aspirin to heart attack patients improves their chances of survival because the aspirin blocks the formation of new blood clots.

Atropine was named after the Greek goddess Atropos, the oldest and ugliest of the three sisters known as the Fates, who controlled the destiny of men.

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.

Russia has the highest death rate from cardiovascular disease followed by the Ukraine, Romania, Hungary, and Poland.

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.