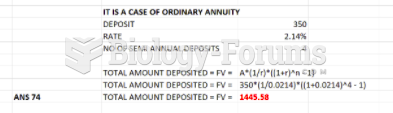

Answer to Question 1

C

Answer to Question 2

In perfect markets, the firm incurs no costs when it issues new securities. However, in reality the process is quite

expensive, and this means that new equity capital raised through the sale of common stock will be more expensive

than capital raised via retained earnings. Thus, if managers choose to issue stock rather than retain profits to finance

new investments, a larger amount of securities is required to finance the investment.

In effect, flotation costs eliminate our indifference between using internal capital versus issuing new common stock.

Given these costs, dividends should be paid only if the firm's profits are not completely used for investment purposes.

That is, only residual earnings should be paid out. This policy is called the residual dividend theory.

Thus, dividend policy is influenced by 1. the company's investment opportunities and 2. the availability of internally

generated capital. Dividends are then paid only after all acceptable investments have been financed. According to this

concept, a dividend policy is totally passive in nature and can't affect the market price of the common stock.

What if the investors do not like the dividend policy chosen by managers? In perfect markets, in which we incur no

costs when buying or selling stock, there is no problem. Investors can satisfy their personal income preferences by

purchasing or selling securities when the dividends they receive do not satisfy their current needs.

However, once we remove the assumption of perfect markets, we find that buying or selling stock is not cost free. As a

result of these considerations, investors may not be too inclined to buy stocks that require them to create a dividend

stream more suitable to their purposes. Rather, if investors do in fact have a preference between dividends and capital

gains, we could expect them to invest in firms that have a dividend policy consistent with these preferences. In other

words, there would be a clientele effect: Firms draw a given clientele, depending on their stated dividend policy.