|

|

|

Did you know?

Hyperthyroidism leads to an increased rate of metabolism and affects about 1% of women but only 0.1% of men. For most people, this increased metabolic rate causes the thyroid gland to become enlarged (known as a goiter).

Did you know?

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.

Did you know?

The horizontal fraction bar was introduced by the Arabs.

Did you know?

People with high total cholesterol have about two times the risk for heart disease as people with ideal levels.

Did you know?

Side effects from substance abuse include nausea, dehydration, reduced productivitiy, and dependence. Though these effects usually worsen over time, the constant need for the substance often overcomes rational thinking.

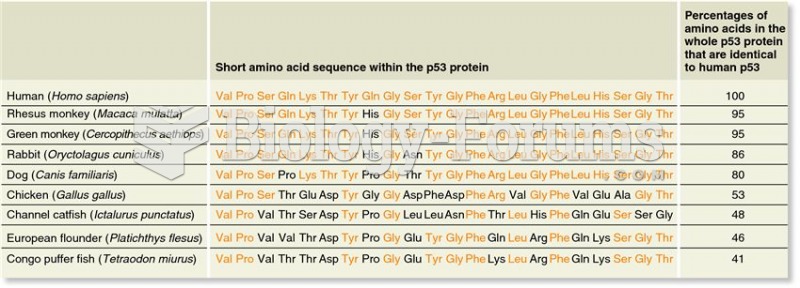

An example of genetic homology: a comparison of a short amino acid sequence within the p53 protein f

An example of genetic homology: a comparison of a short amino acid sequence within the p53 protein f

Midway Island, an inhospitable atoll acquired in 1867, was valuable as a military base located midwa

Midway Island, an inhospitable atoll acquired in 1867, was valuable as a military base located midwa