|

|

|

Bacteria have been found alive in a lake buried one half mile under ice in Antarctica.

Urine turns bright yellow if larger than normal amounts of certain substances are consumed; one of these substances is asparagus.

Drug-induced pharmacodynamic effects manifested in older adults include drug-induced renal toxicity, which can be a major factor when these adults are experiencing other kidney problems.

Every flu season is different, and even healthy people can get extremely sick from the flu, as well as spread it to others. The flu season can begin as early as October and last as late as May. Every person over six months of age should get an annual flu vaccine. The vaccine cannot cause you to get influenza, but in some seasons, may not be completely able to prevent you from acquiring influenza due to changes in causative viruses. The viruses in the flu shot are killed—there is no way they can give you the flu. Minor side effects include soreness, redness, or swelling where the shot was given. It is possible to develop a slight fever, and body aches, but these are simply signs that the body is responding to the vaccine and making itself ready to fight off the influenza virus should you come in contact with it.

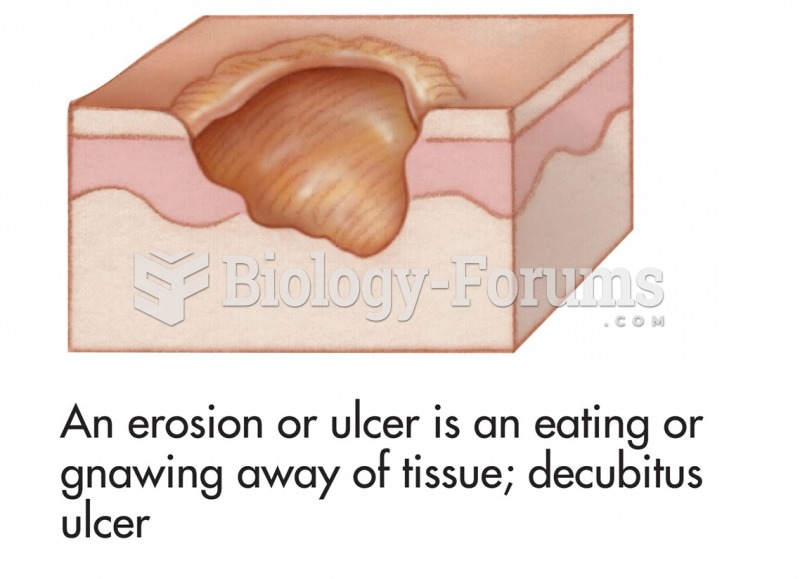

To prove that stomach ulcers were caused by bacteria and not by stress, a researcher consumed an entire laboratory beaker full of bacterial culture. After this, he did indeed develop stomach ulcers, and won the Nobel Prize for his discovery.