|

|

|

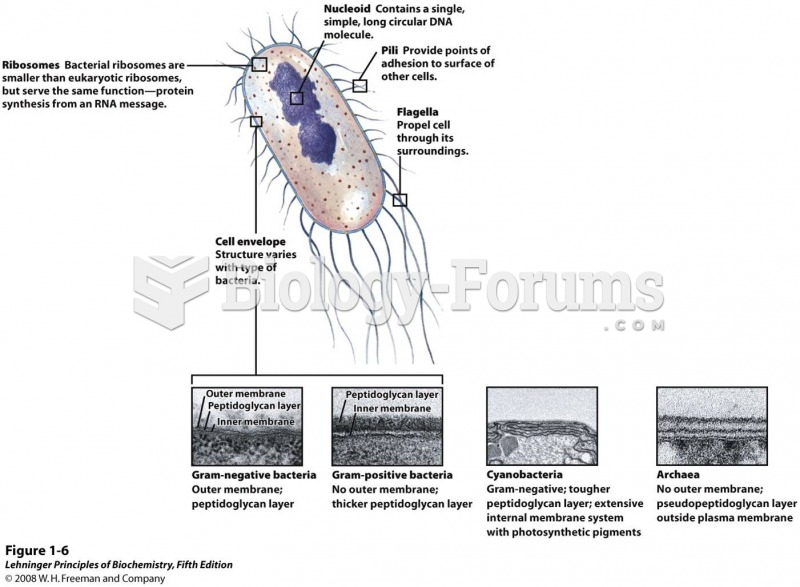

Interferon was scarce and expensive until 1980, when the interferon gene was inserted into bacteria using recombinant DNA technology, allowing for mass cultivation and purification from bacterial cultures.

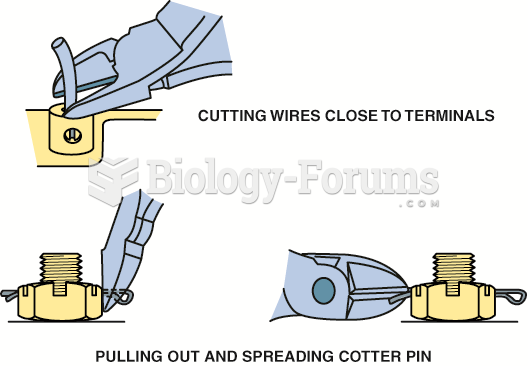

Always store hazardous household chemicals in their original containers out of reach of children. These include bleach, paint, strippers and products containing turpentine, garden chemicals, oven cleaners, fondue fuels, nail polish, and nail polish remover.

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.

According to research, pregnant women tend to eat more if carrying a baby boy. Male fetuses may secrete a chemical that stimulates their mothers to step up her energy intake.

Computer programs are available that crosscheck a new drug's possible trade name with all other trade names currently available. These programs detect dangerous similarities between names and alert the manufacturer of the drug.