|

|

|

Did you know?

Anti-aging claims should not ever be believed. There is no supplement, medication, or any other substance that has been proven to slow or stop the aging process.

Did you know?

Nitroglycerin is used to alleviate various heart-related conditions, and it is also the chief component of dynamite (but mixed in a solid clay base to stabilize it).

Did you know?

In ancient Rome, many of the richer people in the population had lead-induced gout. The reason for this is unclear. Lead poisoning has also been linked to madness.

Did you know?

Everyone has one nostril that is larger than the other.

Did you know?

Allergies play a major part in the health of children. The most prevalent childhood allergies are milk, egg, soy, wheat, peanuts, tree nuts, and seafood.

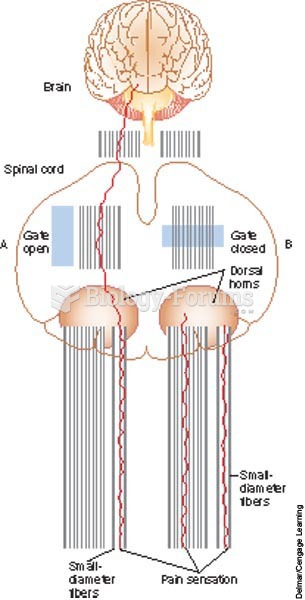

Gate Control Theory, Gate control, Open gate, Closed gate, Pain, Nerve transmission of pain, Pain ma

Gate Control Theory, Gate control, Open gate, Closed gate, Pain, Nerve transmission of pain, Pain ma

Parents who grew up in dual-earner families are more apt to share household tasks equally than those ...

Parents who grew up in dual-earner families are more apt to share household tasks equally than those ...