|

|

|

Multiple sclerosis is a condition wherein the body's nervous system is weakened by an autoimmune reaction that attacks the myelin sheaths of neurons.

Critical care patients are twice as likely to receive the wrong medication. Of these errors, 20% are life-threatening, and 42% require additional life-sustaining treatments.

Cucumber slices relieve headaches by tightening blood vessels, reducing blood flow to the area, and relieving pressure.

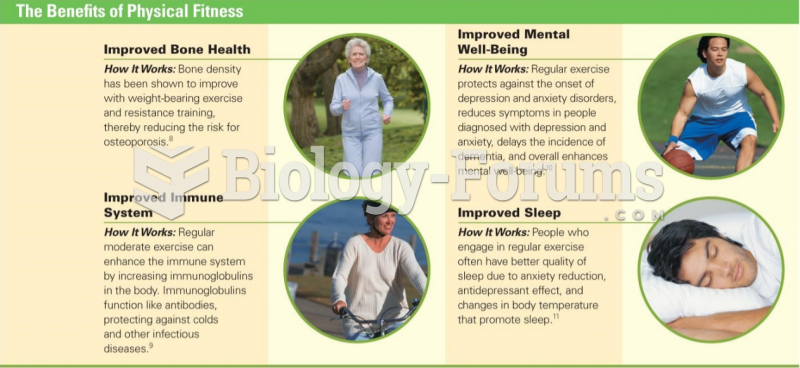

Hip fractures are the most serious consequences of osteoporosis. The incidence of hip fractures increases with each decade among patients in their 60s to patients in their 90s for both women and men of all populations. Men and women older than 80 years of age show the highest incidence of hip fractures.

Fungal nail infections account for up to 30% of all skin infections. They affect 5% of the general population—mostly people over the age of 70.