|

|

|

Multiple sclerosis is a condition wherein the body's nervous system is weakened by an autoimmune reaction that attacks the myelin sheaths of neurons.

When intravenous medications are involved in adverse drug events, their harmful effects may occur more rapidly, and be more severe than errors with oral medications. This is due to the direct administration into the bloodstream.

As the western states of America were settled, pioneers often had to drink rancid water from ponds and other sources. This often resulted in chronic diarrhea, causing many cases of dehydration and death that could have been avoided if clean water had been available.

Common abbreviations that cause medication errors include U (unit), mg (milligram), QD (every day), SC (subcutaneous), TIW (three times per week), D/C (discharge or discontinue), HS (at bedtime or "hours of sleep"), cc (cubic centimeters), and AU (each ear).

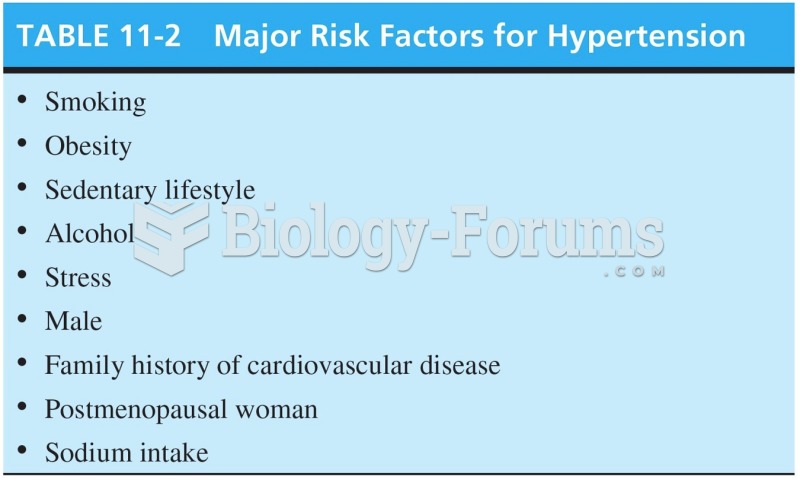

Hypertension is a silent killer because it is deadly and has no significant early symptoms. The danger from hypertension is the extra load on the heart, which can lead to hypertensive heart disease and kidney damage. This occurs without any major symptoms until the high blood pressure becomes extreme. Regular blood pressure checks are an important method of catching hypertension before it can kill you.