|

|

|

Limit intake of red meat and dairy products made with whole milk. Choose skim milk, low-fat or fat-free dairy products. Limit fried food. Use healthy oils when cooking.

The tallest man ever known was Robert Wadlow, an American, who reached the height of 8 feet 11 inches. He died at age 26 years from an infection caused by the immense weight of his body (491 pounds) and the stress on his leg bones and muscles.

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.

Adult head lice are gray, about ? inch long, and often have a tiny dot on their backs. A female can lay between 50 and 150 eggs within the several weeks that she is alive. They feed on human blood.

No drugs are available to relieve parathyroid disease. Parathyroid disease is caused by a parathyroid tumor, and it needs to be removed by surgery.

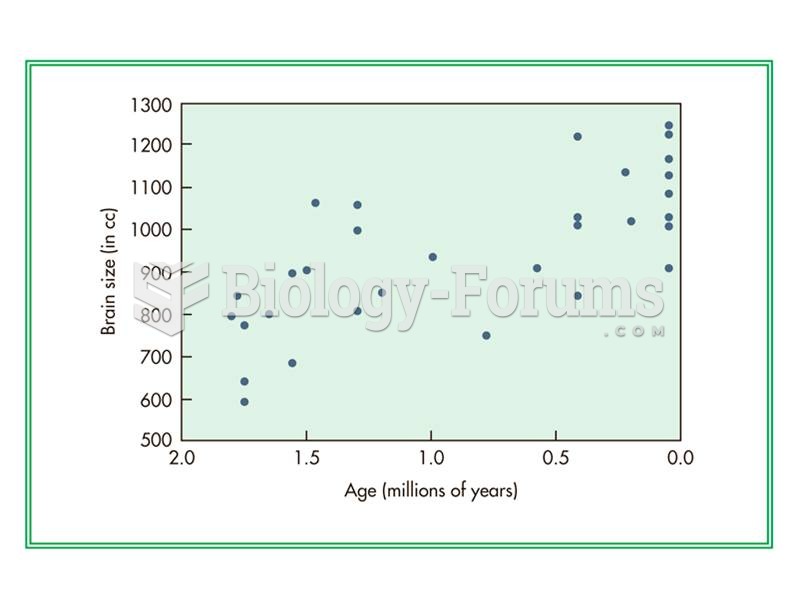

Although average brain size increases gradually though time in H. erectus, individuals with small br

Although average brain size increases gradually though time in H. erectus, individuals with small br

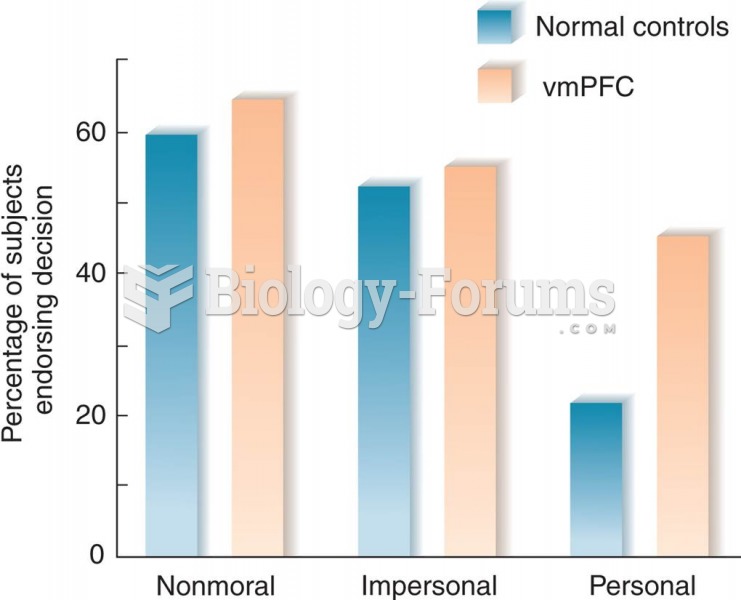

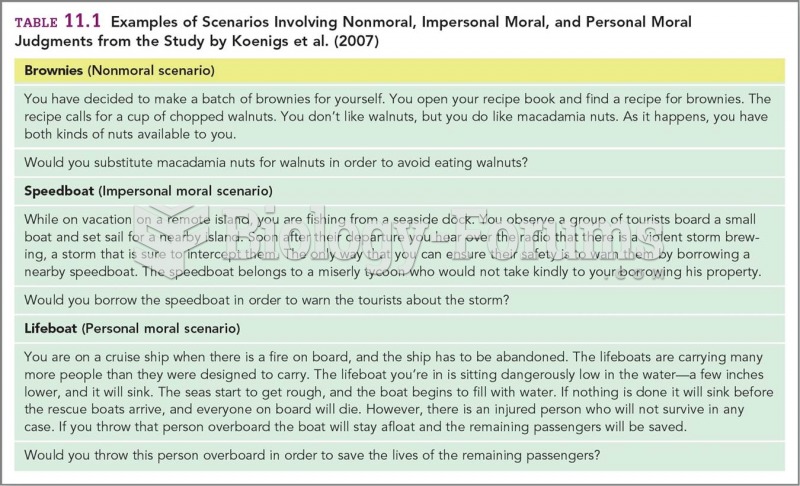

Examples of Scenarios Involving Nonmoral, Impersonal Moral, and Personal Moral Judgments from the St

Examples of Scenarios Involving Nonmoral, Impersonal Moral, and Personal Moral Judgments from the St