|

|

|

People about to have surgery must tell their health care providers about all supplements they take.

Though newer “smart” infusion pumps are increasingly becoming more sophisticated, they cannot prevent all programming and administration errors. Health care professionals that use smart infusion pumps must still practice the rights of medication administration and have other professionals double-check all high-risk infusions.

The term pharmacology is derived from the Greek words pharmakon("claim, medicine, poison, or remedy") and logos ("study").

People often find it difficult to accept the idea that bacteria can be beneficial and improve health. Lactic acid bacteria are good, and when eaten, these bacteria improve health and increase longevity. These bacteria included in foods such as yogurt.

In the United States, congenital cytomegalovirus causes one child to become disabled almost every hour. CMV is the leading preventable viral cause of development disability in newborns. These disabilities include hearing or vision loss, and cerebral palsy.

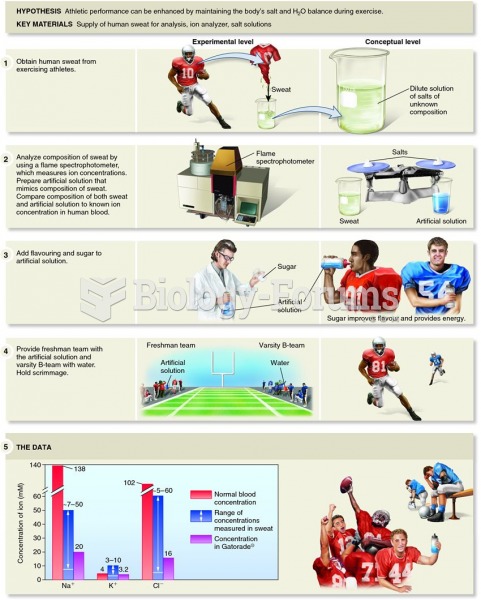

Cade and colleagues discovered a way to improve athletic performance and prevent salt and water imba

Cade and colleagues discovered a way to improve athletic performance and prevent salt and water imba

Old-growth redwood forest in western North America. Redwoods are the tallest trees in the world, wit

Old-growth redwood forest in western North America. Redwoods are the tallest trees in the world, wit