|

|

|

Essential fatty acids have been shown to be effective against ulcers, asthma, dental cavities, and skin disorders such as acne.

ACTH levels are normally highest in the early morning (between 6 and 8 A.M.) and lowest in the evening (between 6 and 11 P.M.). Therefore, a doctor who suspects abnormal levels looks for low ACTH in the morning and high ACTH in the evening.

Drying your hands with a paper towel will reduce the bacterial count on your hands by 45–60%.

The U.S. Pharmacopeia Medication Errors Reporting Program states that approximately 50% of all medication errors involve insulin.

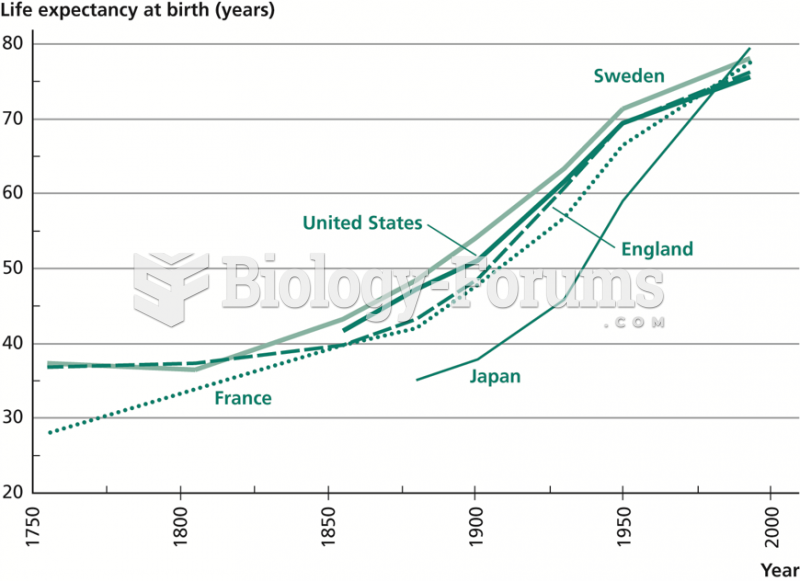

The oldest recorded age was 122. Madame Jeanne Calment was born in France in 1875 and died in 1997. She was a vegetarian and loved olive oil, port wine, and chocolate.