This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Drug-induced pharmacodynamic effects manifested in older adults include drug-induced renal toxicity, which can be a major factor when these adults are experiencing other kidney problems.

Did you know?

Your heart beats over 36 million times a year.

Did you know?

The most common childhood diseases include croup, chickenpox, ear infections, flu, pneumonia, ringworm, respiratory syncytial virus, scabies, head lice, and asthma.

Did you know?

Atropine was named after the Greek goddess Atropos, the oldest and ugliest of the three sisters known as the Fates, who controlled the destiny of men.

Did you know?

Aspirin may benefit 11 different cancers, including those of the colon, pancreas, lungs, prostate, breasts, and leukemia.

Alligators are apex predators capable of killing large terrestrial prey. This large AAmerican alliga

Alligators are apex predators capable of killing large terrestrial prey. This large AAmerican alliga

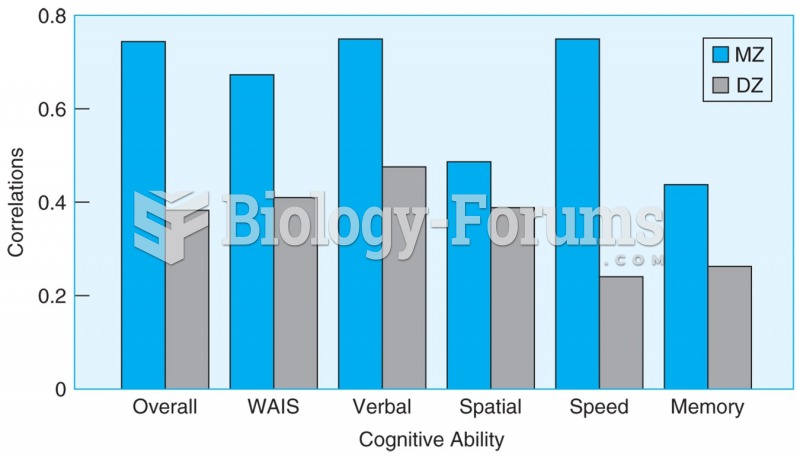

Correlations on tests for a number of cognitive abilities are higher for monozygotic twin pairs (who ...

Correlations on tests for a number of cognitive abilities are higher for monozygotic twin pairs (who ...