|

|

|

Medication errors are more common among seriously ill patients than with those with minor conditions.

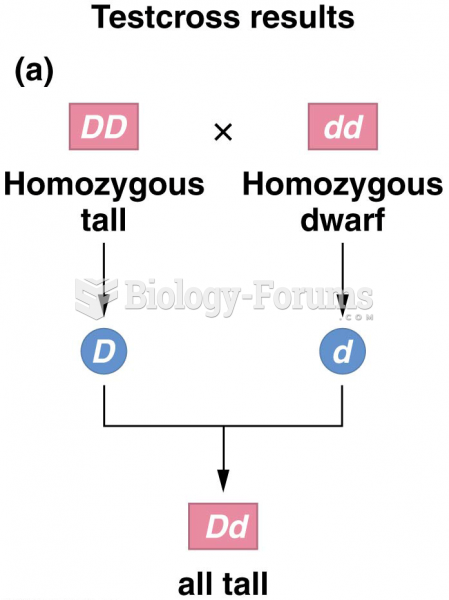

The shortest mature adult human of whom there is independent evidence was Gul Mohammed in India. In 1990, he was measured in New Delhi and stood 22.5 inches tall.

All adults should have their cholesterol levels checked once every 5 years. During 2009–2010, 69.4% of Americans age 20 and older reported having their cholesterol checked within the last five years.

More than 50% of American adults have oral herpes, which is commonly known as "cold sores" or "fever blisters." The herpes virus can be active on the skin surface without showing any signs or causing any symptoms.

More than 30% of American adults, and about 12% of children utilize health care approaches that were developed outside of conventional medicine.