This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

On average, the stomach produces 2 L of hydrochloric acid per day.

Did you know?

The term bacteria was devised in the 19th century by German biologist Ferdinand Cohn. He based it on the Greek word "bakterion" meaning a small rod or staff. Cohn is considered to be the father of modern bacteriology.

Did you know?

The immune system needs 9.5 hours of sleep in total darkness to recharge completely.

Did you know?

HIV testing reach is still limited. An estimated 40% of people with HIV (more than 14 million) remain undiagnosed and do not know their infection status.

Did you know?

Patients should never assume they are being given the appropriate drugs. They should make sure they know which drugs are being prescribed, and always double-check that the drugs received match the prescription.

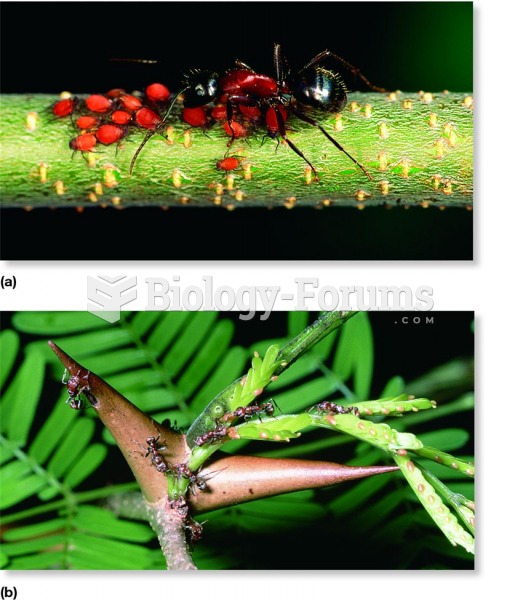

Defensive mutualism involves species that receive food or shelter in return for providing protection

Defensive mutualism involves species that receive food or shelter in return for providing protection

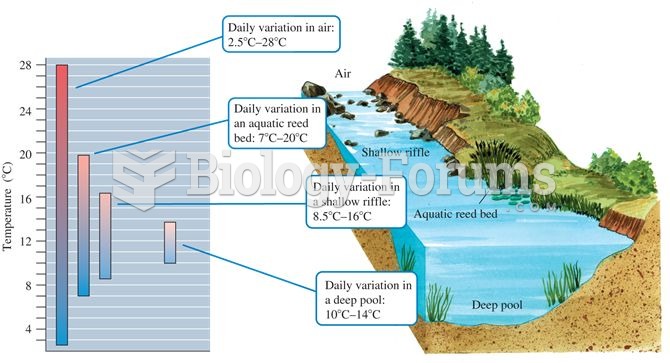

Aquatic microclimates: aquatic environments generally show less temperature variation compared to te

Aquatic microclimates: aquatic environments generally show less temperature variation compared to te

Mutualisms, such as those that occur among plants and pollinators, generally involve large numbers o

Mutualisms, such as those that occur among plants and pollinators, generally involve large numbers o