|

|

|

The U.S. Pharmacopeia Medication Errors Reporting Program states that approximately 50% of all medication errors involve insulin.

The use of salicylates dates back 2,500 years to Hippocrates's recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Opium has influenced much of the world's most popular literature. The following authors were all opium users, of varying degrees: Lewis Carroll, Charles, Dickens, Arthur Conan Doyle, and Oscar Wilde.

The eye muscles are the most active muscles in the whole body. The external muscles that move the eyes are the strongest muscles in the human body for the job they have to do. They are 100 times more powerful than they need to be.

Allergies play a major part in the health of children. The most prevalent childhood allergies are milk, egg, soy, wheat, peanuts, tree nuts, and seafood.

If raising a vehicle without a frame, place the flat pads under the pinch weld seam to spread the ...

If raising a vehicle without a frame, place the flat pads under the pinch weld seam to spread the ...

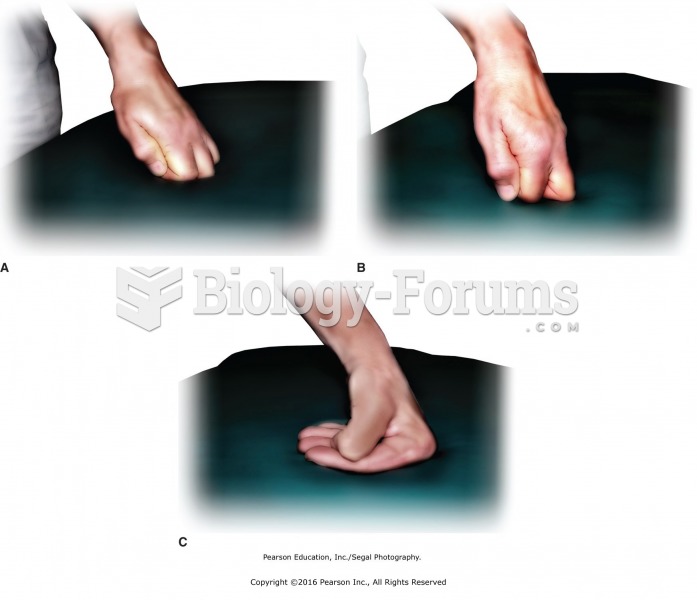

Different hand positions and working surfaces for massage applications on large muscles. A. Flat ...

Different hand positions and working surfaces for massage applications on large muscles. A. Flat ...