|

|

|

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

Approximately 25% of all reported medication errors result from some kind of name confusion.

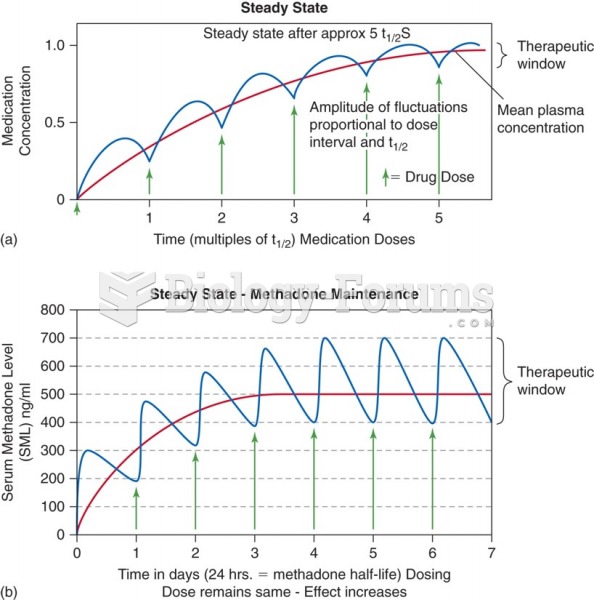

Though methadone is often used to treat dependency on other opioids, the drug itself can be abused. Crushing or snorting methadone can achieve the opiate "rush" desired by addicts. Improper use such as these can lead to a dangerous dependency on methadone. This drug now accounts for nearly one-third of opioid-related deaths.

Individuals are never “cured” of addictions. Instead, they learn how to manage their disease to lead healthy, balanced lives.

Most strokes are caused when blood clots move to a blood vessel in the brain and block blood flow to that area. Thrombolytic therapy can be used to dissolve the clot quickly. If given within 3 hours of the first stroke symptoms, this therapy can help limit stroke damage and disability.