This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Excessive alcohol use costs the country approximately $235 billion every year.

Did you know?

Blood in the urine can be a sign of a kidney stone, glomerulonephritis, or other kidney problems.

Did you know?

The average office desk has 400 times more bacteria on it than a toilet.

Did you know?

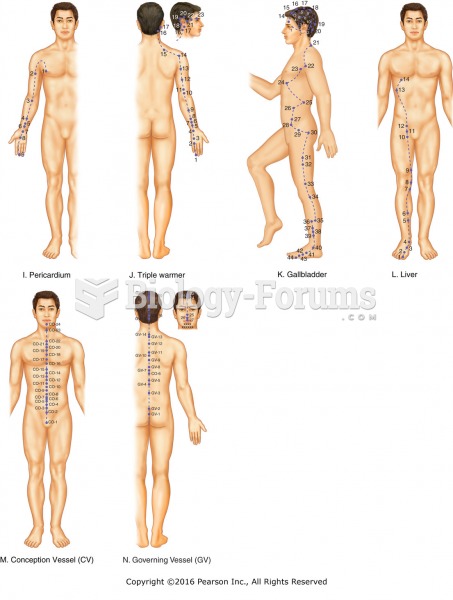

The National Institutes of Health have supported research into acupuncture. This has shown that acupuncture significantly reduced pain associated with osteoarthritis of the knee, when used as a complement to conventional therapies.

Did you know?

When intravenous medications are involved in adverse drug events, their harmful effects may occur more rapidly, and be more severe than errors with oral medications. This is due to the direct administration into the bloodstream.