|

|

|

Pregnant women usually experience a heightened sense of smell beginning late in the first trimester. Some experts call this the body's way of protecting a pregnant woman from foods that are unsafe for the fetus.

Increased intake of vitamin D has been shown to reduce fractures up to 25% in older people.

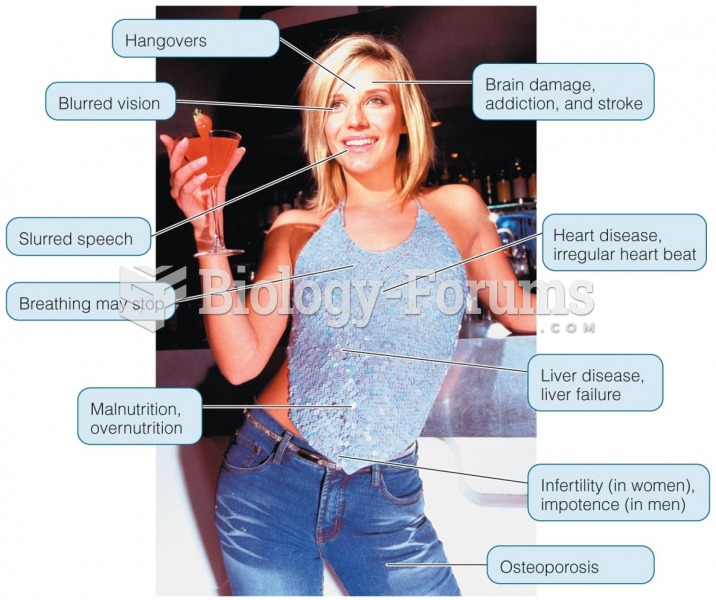

Illness; diuretics; laxative abuse; hot weather; exercise; sweating; caffeine; alcoholic beverages; starvation diets; inadequate carbohydrate consumption; and diets high in protein, salt, or fiber can cause people to become dehydrated.

As many as 28% of hospitalized patients requiring mechanical ventilators to help them breathe (for more than 48 hours) will develop ventilator-associated pneumonia. Current therapy involves intravenous antibiotics, but new antibiotics that can be inhaled (and more directly treat the infection) are being developed.

Nearly all drugs pass into human breast milk. How often a drug is taken influences the amount of drug that will pass into the milk. Medications taken 30 to 60 minutes before breastfeeding are likely to be at peak blood levels when the baby is nursing.