|

|

|

There are immediate benefits of chiropractic adjustments that are visible via magnetic resonance imaging (MRI). It shows that spinal manipulation therapy is effective in decreasing pain and increasing the gaps between the vertebrae, reducing pressure that leads to pain.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

About 3.2 billion people, nearly half the world population, are at risk for malaria. In 2015, there are about 214 million malaria cases and an estimated 438,000 malaria deaths.

No drugs are available to relieve parathyroid disease. Parathyroid disease is caused by a parathyroid tumor, and it needs to be removed by surgery.

There are more bacteria in your mouth than there are people in the world.

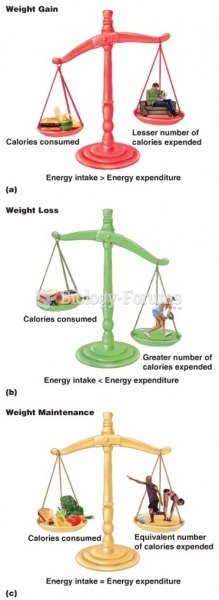

Like all animals, primates must balance their calories expended searching for food with calories, pr

Like all animals, primates must balance their calories expended searching for food with calories, pr

Creating a tent for turning from prone to supine or vice versa. Pin one side of the sheet against ...

Creating a tent for turning from prone to supine or vice versa. Pin one side of the sheet against ...