|

|

|

The first successful kidney transplant was performed in 1954 and occurred in Boston. A kidney from an identical twin was transplanted into his dying brother's body and was not rejected because it did not appear foreign to his body.

Long-term mental and physical effects from substance abuse include: paranoia, psychosis, immune deficiencies, and organ damage.

Studies show that systolic blood pressure can be significantly lowered by taking statins. In fact, the higher the patient's baseline blood pressure, the greater the effect of statins on his or her blood pressure.

Though “Krazy Glue” or “Super Glue” has the ability to seal small wounds, it is not recommended for this purpose since it contains many substances that should not enter the body through the skin, and may be harmful.

All patients with hyperparathyroidism will develop osteoporosis. The parathyroid glands maintain blood calcium within the normal range. All patients with this disease will continue to lose calcium from their bones every day, and there is no way to prevent the development of osteoporosis as a result.

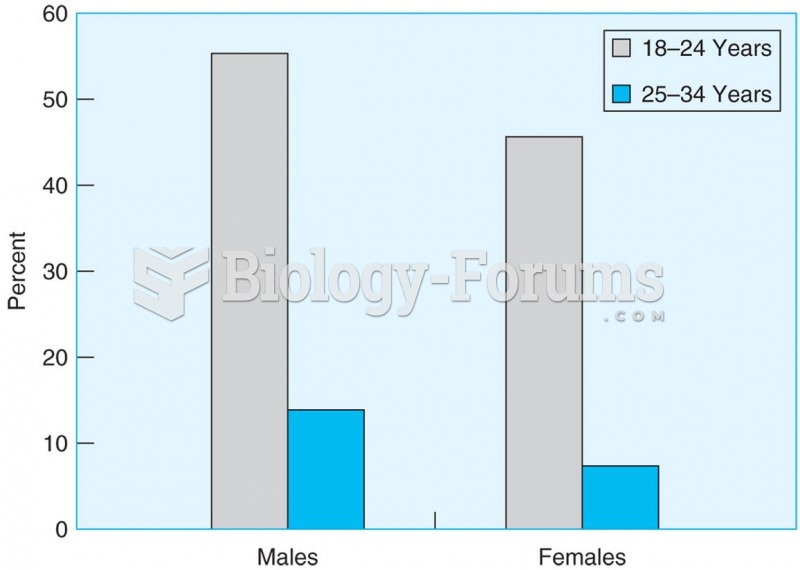

More young men than women live in their parents’ homes, though the proportion for both decreases ...

More young men than women live in their parents’ homes, though the proportion for both decreases ...

One target for expanding medical services involves vaccinations. Only 78 percent of children ages 19 ...

One target for expanding medical services involves vaccinations. Only 78 percent of children ages 19 ...