|

|

|

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

Chronic marijuana use can damage the white blood cells and reduce the immune system's ability to respond to disease by as much as 40%. Without a strong immune system, the body is vulnerable to all kinds of degenerative and infectious diseases.

Every flu season is different, and even healthy people can get extremely sick from the flu, as well as spread it to others. The flu season can begin as early as October and last as late as May. Every person over six months of age should get an annual flu vaccine. The vaccine cannot cause you to get influenza, but in some seasons, may not be completely able to prevent you from acquiring influenza due to changes in causative viruses. The viruses in the flu shot are killed—there is no way they can give you the flu. Minor side effects include soreness, redness, or swelling where the shot was given. It is possible to develop a slight fever, and body aches, but these are simply signs that the body is responding to the vaccine and making itself ready to fight off the influenza virus should you come in contact with it.

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.

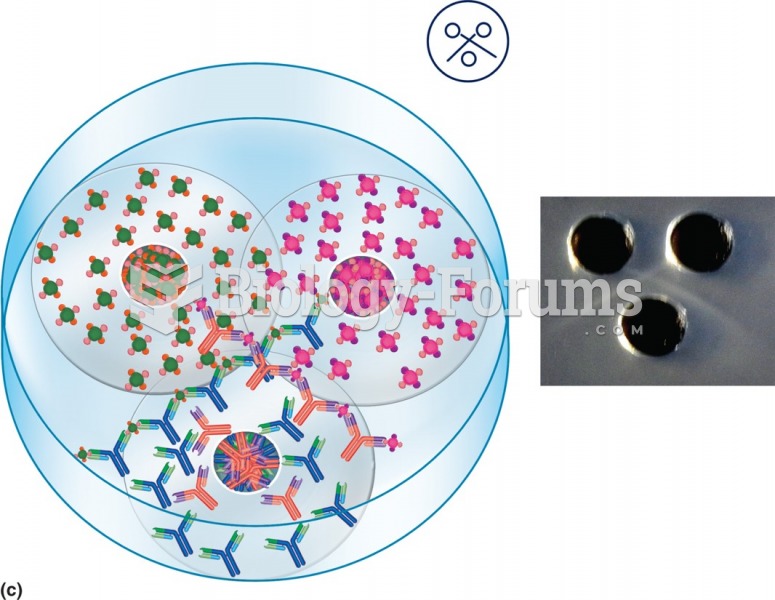

Immunoglobulin injections may give short-term protection against, or reduce severity of certain diseases. They help people who have an inherited problem making their own antibodies, or those who are having certain types of cancer treatments.

Behavior modification has been useful in raising the amount of social responding by children with ...

Behavior modification has been useful in raising the amount of social responding by children with ...

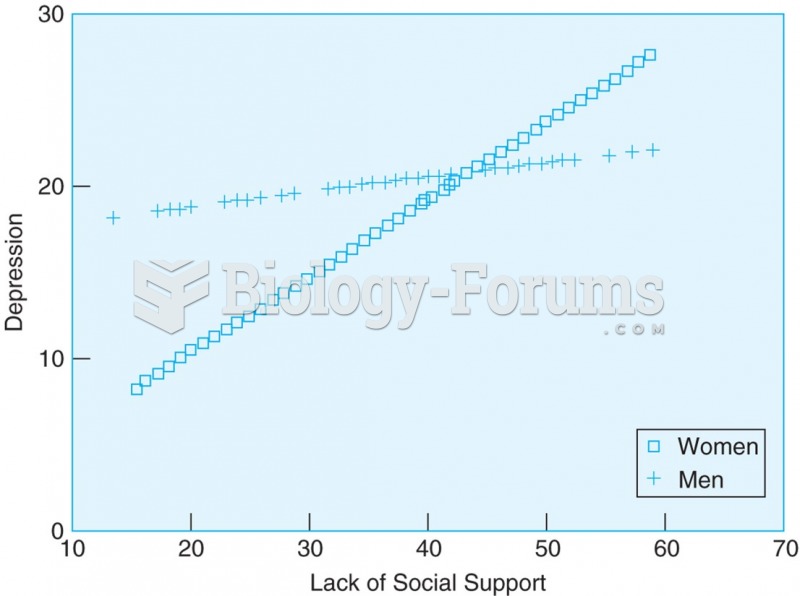

For Gulf War veterans, lack of social support in the field is related to postwar depression. The ...

For Gulf War veterans, lack of social support in the field is related to postwar depression. The ...