|

|

|

The top 10 most important tips that will help you grow old gracefully include (1) quit smoking, (2) keep your weight down, (3) take supplements, (4) skip a meal each day or fast 1 day per week, (5) get a pet, (6) get medical help for chronic pain, (7) walk regularly, (8) reduce arguments, (9) put live plants in your living space, and (10) do some weight training.

The lipid bilayer is made of phospholipids. They are arranged in a double layer because one of their ends is attracted to water while the other is repelled by water.

Many of the drugs used by neuroscientists are derived from toxic plants and venomous animals (such as snakes, spiders, snails, and puffer fish).

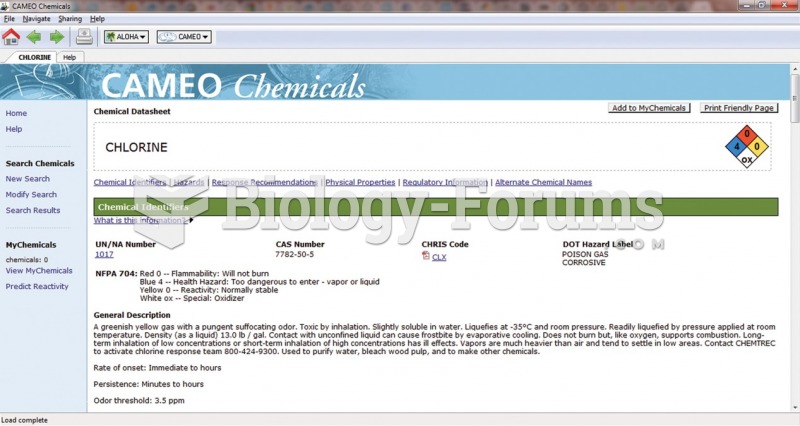

Certain rare plants containing cyanide include apricot pits and a type of potato called cassava. Fortunately, only chronic or massive ingestion of any of these plants can lead to serious poisoning.

In 2010, opiate painkllers, such as morphine, OxyContin®, and Vicodin®, were tied to almost 60% of drug overdose deaths.