|

|

|

About 3% of all pregnant women will give birth to twins, which is an increase in rate of nearly 60% since the early 1980s.

The human body's pharmacokinetics are quite varied. Our hair holds onto drugs longer than our urine, blood, or saliva. For example, alcohol can be detected in the hair for up to 90 days after it was consumed. The same is true for marijuana, cocaine, ecstasy, heroin, methamphetamine, and nicotine.

In the United States, congenital cytomegalovirus causes one child to become disabled almost every hour. CMV is the leading preventable viral cause of development disability in newborns. These disabilities include hearing or vision loss, and cerebral palsy.

Normal urine is sterile. It contains fluids, salts, and waste products. It is free of bacteria, viruses, and fungi.

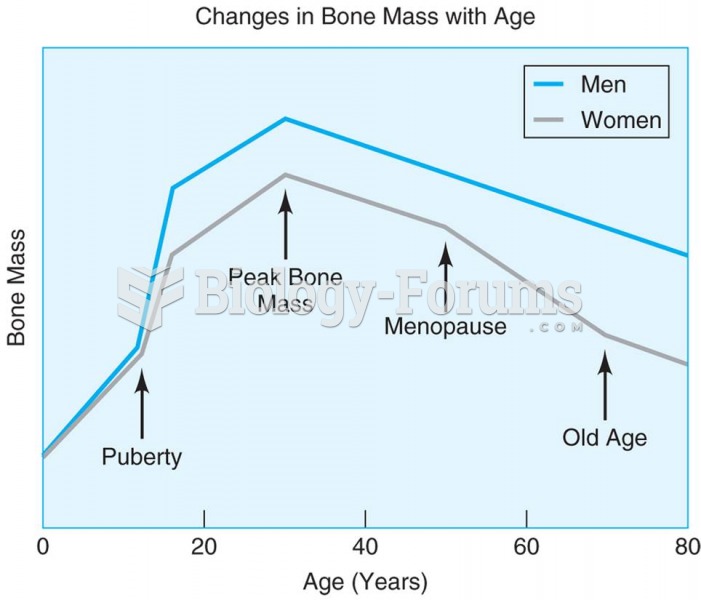

The U.S. Preventive Services Task Force recommends that all women age 65 years of age or older should be screened with bone densitometry.

Stereo Image taken by NASA STEREO Probes launched in 2006; utilizing two Spacecrafts to image the Su

Stereo Image taken by NASA STEREO Probes launched in 2006; utilizing two Spacecrafts to image the Su

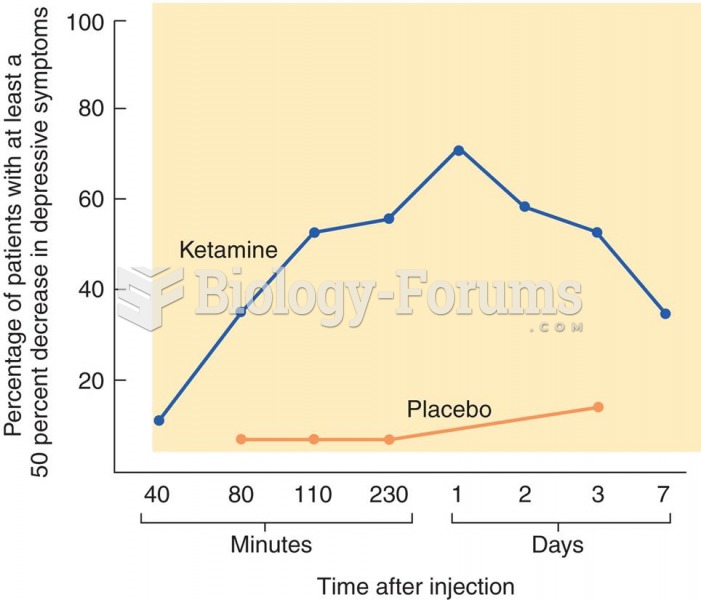

Treatment of Depression with Ketamine The graph shows the effects of ketamine on symptoms of depress

Treatment of Depression with Ketamine The graph shows the effects of ketamine on symptoms of depress

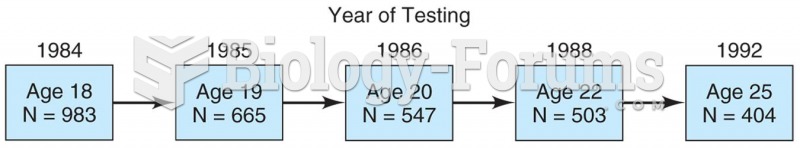

Model of a longitudinal study in which 983 students were surveyed in 1984 and then again in 1985, 19

Model of a longitudinal study in which 983 students were surveyed in 1984 and then again in 1985, 19