|

|

|

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

People with alcoholism are at a much greater risk of malnutrition than are other people and usually exhibit low levels of most vitamins (especially folic acid). This is because alcohol often takes the place of 50% of their daily intake of calories, with little nutritional value contained in it.

Though “Krazy Glue” or “Super Glue” has the ability to seal small wounds, it is not recommended for this purpose since it contains many substances that should not enter the body through the skin, and may be harmful.

For about 100 years, scientists thought that peptic ulcers were caused by stress, spicy food, and alcohol. Later, researchers added stomach acid to the list of causes and began treating ulcers with antacids. Now it is known that peptic ulcers are predominantly caused by Helicobacter pylori, a spiral-shaped bacterium that normally exist in the stomach.

Certain topical medications such as clotrimazole and betamethasone are not approved for use in children younger than 12 years of age. They must be used very cautiously, as directed by a doctor, to treat any child. Children have a much greater response to topical steroid medications.

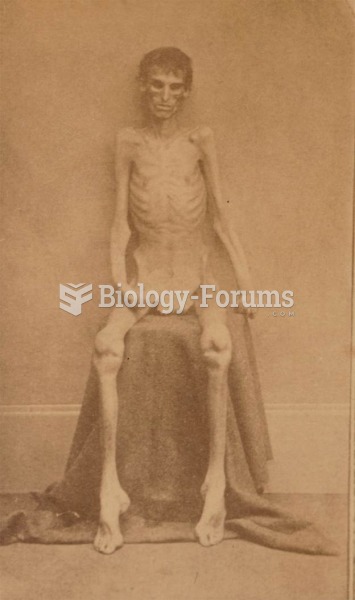

This photograph of a Union soldier just freed from Andersonville prison, stunned and enraged norther

This photograph of a Union soldier just freed from Andersonville prison, stunned and enraged norther

Specialized values and interests are two of the characteristics that mark subcultures. What values ...

Specialized values and interests are two of the characteristics that mark subcultures. What values ...

In Hindu marriages, the roles of husband and wife are firmly established. Neither this woman, whom I ...

In Hindu marriages, the roles of husband and wife are firmly established. Neither this woman, whom I ...