|

|

|

Malaria was not eliminated in the United States until 1951. The term eliminated means that no new cases arise in a country for 3 years.

More than nineteen million Americans carry the factor V gene that causes blood clots, pulmonary embolism, and heart disease.

Astigmatism is the most common vision problem. It may accompany nearsightedness or farsightedness. It is usually caused by an irregularly shaped cornea, but sometimes it is the result of an irregularly shaped lens. Either type can be corrected by eyeglasses, contact lenses, or refractive surgery.

People about to have surgery must tell their health care providers about all supplements they take.

Though Candida and Aspergillus species are the most common fungal pathogens causing invasive fungal disease in the immunocompromised, infections due to previously uncommon hyaline and dematiaceous filamentous fungi are occurring more often today. Rare fungal infections, once accurately diagnosed, may require surgical debridement, immunotherapy, and newer antifungals used singly or in combination with older antifungals, on a case-by-case basis.

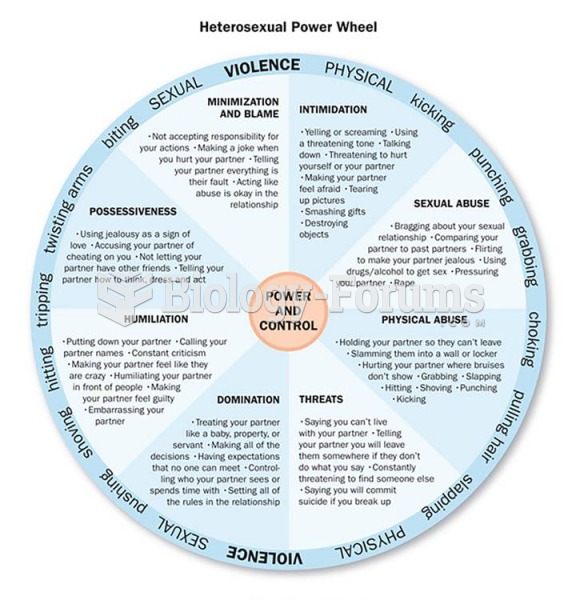

The Power and Control Wheels of Abusive Relationships When one person in a relationship repeatedly ...

The Power and Control Wheels of Abusive Relationships When one person in a relationship repeatedly ...

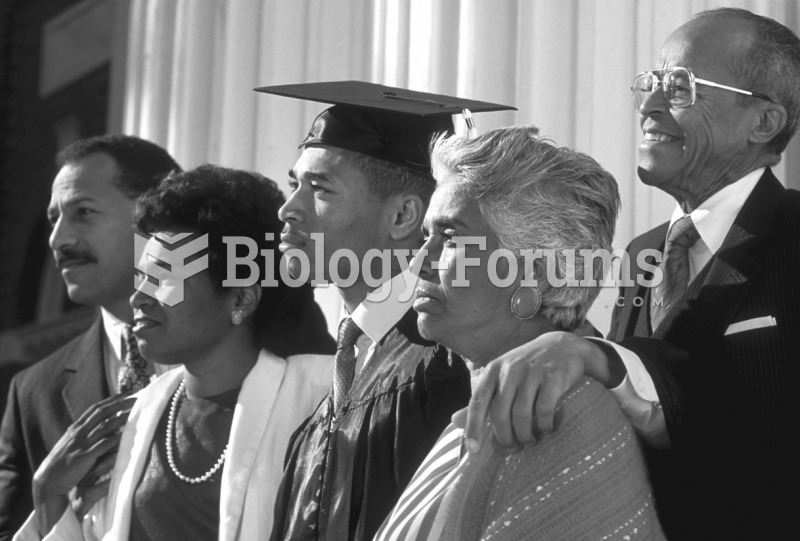

When parents actively support higher education, their children achieve more in their future careers.

When parents actively support higher education, their children achieve more in their future careers.