|

|

|

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.

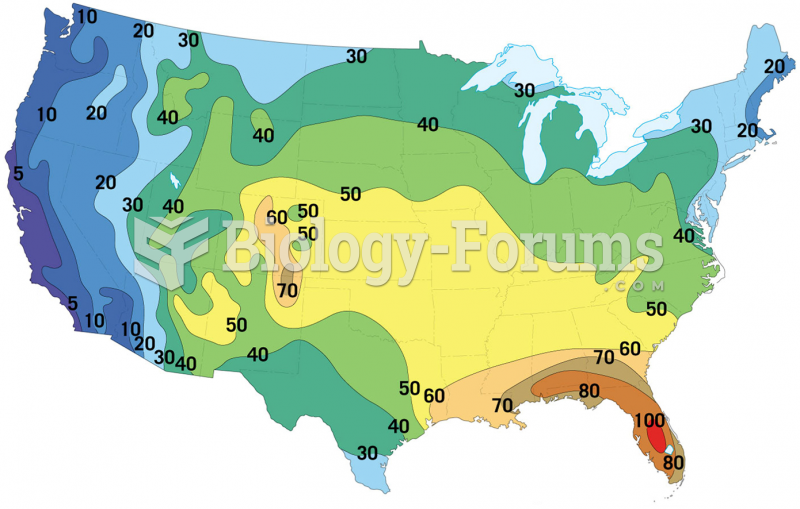

According to the American College of Allergy, Asthma & Immunology, more than 50 million Americans have some kind of food allergy. Food allergies affect between 4 and 6% of children, and 4% of adults, according to the CDC. The most common food allergies include shellfish, peanuts, walnuts, fish, eggs, milk, and soy.

More than 30% of American adults, and about 12% of children utilize health care approaches that were developed outside of conventional medicine.

Drugs are in development that may cure asthma and hay fever once and for all. They target leukotrienes, which are known to cause tightening of the air passages in the lungs and increase mucus productions in nasal passages.