|

|

|

Over time, chronic hepatitis B virus and hepatitis C virus infections can progress to advanced liver disease, liver failure, and hepatocellular carcinoma. Unlike other forms, more than 80% of hepatitis C infections become chronic and lead to liver disease. When combined with hepatitis B, hepatitis C now accounts for 75% percent of all cases of liver disease around the world. Liver failure caused by hepatitis C is now leading cause of liver transplants in the United States.

The cure for trichomoniasis is easy as long as the patient does not drink alcoholic beverages for 24 hours. Just a single dose of medication is needed to rid the body of the disease. However, without proper precautions, an individual may contract the disease repeatedly. In fact, most people develop trichomoniasis again within three months of their last treatment.

Urine turns bright yellow if larger than normal amounts of certain substances are consumed; one of these substances is asparagus.

The most destructive flu epidemic of all times in recorded history occurred in 1918, with approximately 20 million deaths worldwide.

Pink eye is a term that refers to conjunctivitis, which is inflammation of the thin, clear membrane (conjunctiva) over the white part of the eye (sclera). It may be triggered by a virus, bacteria, or foreign body in the eye. Antibiotic eye drops alleviate bacterial conjunctivitis, and antihistamine allergy pills or eye drops help control allergic conjunctivitis symptoms.

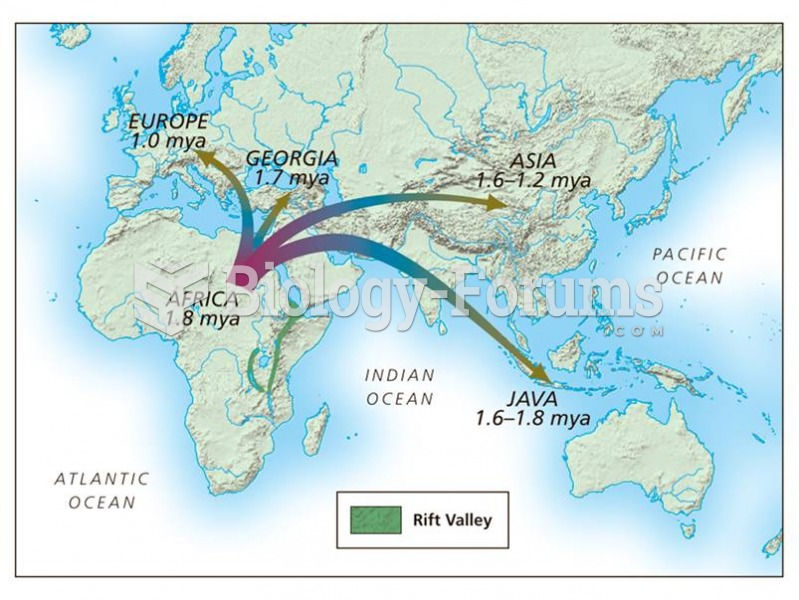

H. erectus migrated out of Africa beginning about 1.8 million years ago and is first known from Geor

H. erectus migrated out of Africa beginning about 1.8 million years ago and is first known from Geor

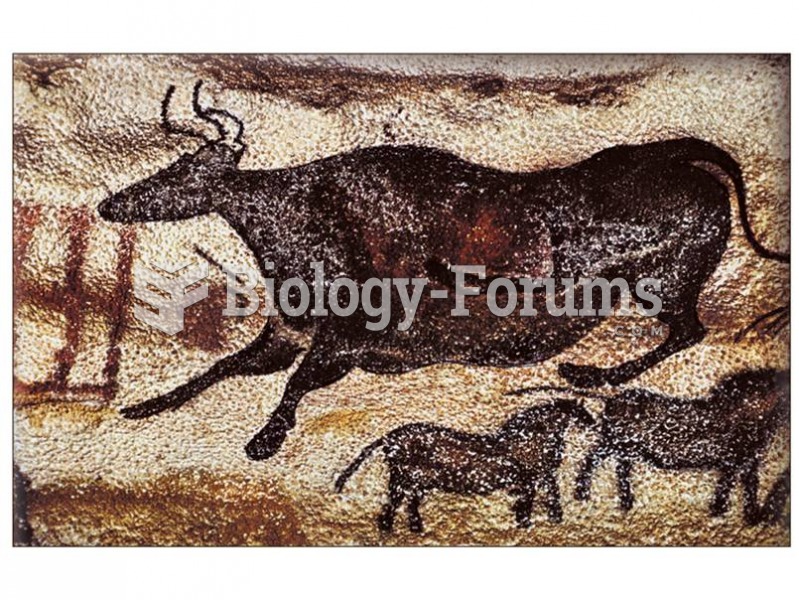

Abundant cave art after about 30,000 years ago is evidence of the importance of symbolic behavior fo

Abundant cave art after about 30,000 years ago is evidence of the importance of symbolic behavior fo

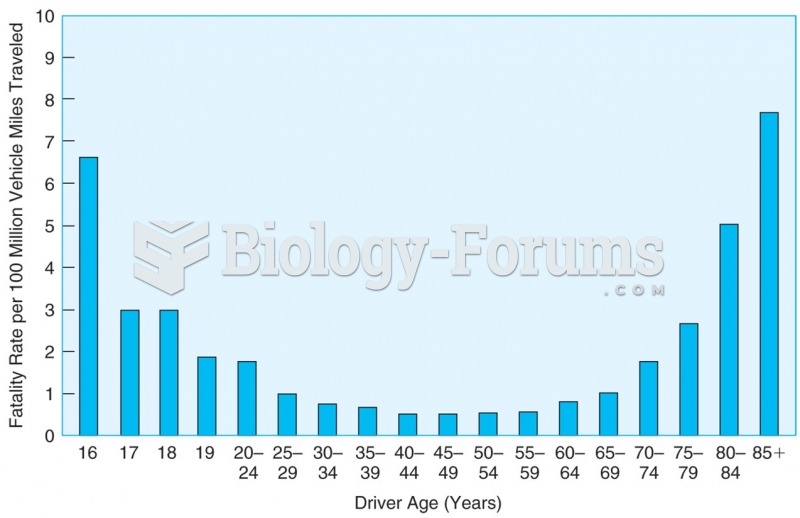

When the number of miles traveled is considered, drivers under 25 years of age and those over 70 are ...

When the number of miles traveled is considered, drivers under 25 years of age and those over 70 are ...