|

|

|

Approximately 25% of all reported medication errors result from some kind of name confusion.

Symptoms of kidney problems include a loss of appetite, back pain (which may be sudden and intense), chills, abdominal pain, fluid retention, nausea, the urge to urinate, vomiting, and fever.

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.

Essential fatty acids have been shown to be effective against ulcers, asthma, dental cavities, and skin disorders such as acne.

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

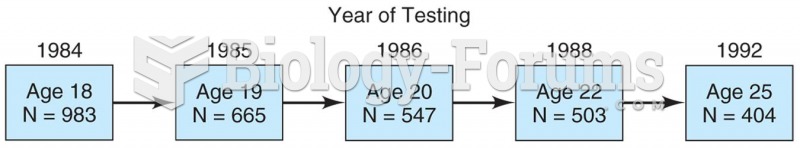

Model of a longitudinal study in which 983 students were surveyed in 1984 and then again in 1985, 19

Model of a longitudinal study in which 983 students were surveyed in 1984 and then again in 1985, 19

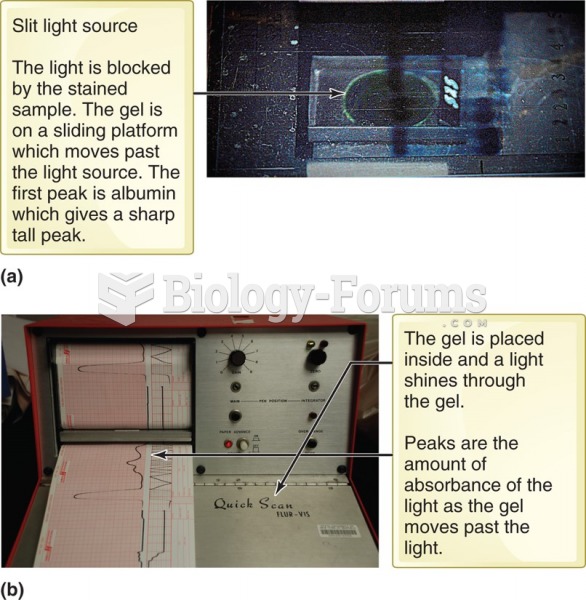

Electrophoresis gel in a densitometer. (a) The green light from the slit light source is visible ...

Electrophoresis gel in a densitometer. (a) The green light from the slit light source is visible ...