|

|

|

The B-complex vitamins and vitamin C are not stored in the body and must be replaced each day.

Russia has the highest death rate from cardiovascular disease followed by the Ukraine, Romania, Hungary, and Poland.

Oliver Wendell Holmes is credited with introducing the words "anesthesia" and "anesthetic" into the English language in 1846.

ACTH levels are normally highest in the early morning (between 6 and 8 A.M.) and lowest in the evening (between 6 and 11 P.M.). Therefore, a doctor who suspects abnormal levels looks for low ACTH in the morning and high ACTH in the evening.

When intravenous medications are involved in adverse drug events, their harmful effects may occur more rapidly, and be more severe than errors with oral medications. This is due to the direct administration into the bloodstream.

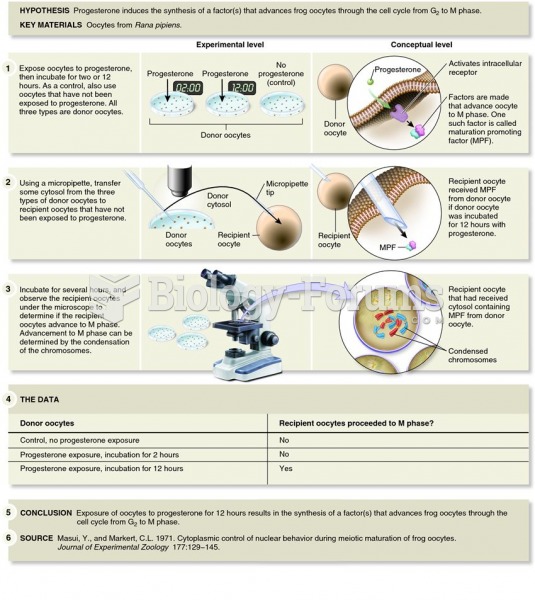

The experimental approach used by Masui and Markert to identify cyclin and cyclin-dependent kinase (

The experimental approach used by Masui and Markert to identify cyclin and cyclin-dependent kinase (

The U.S. military uses its own marking system to identify explosive hazards (left), chemical hazards ...

The U.S. military uses its own marking system to identify explosive hazards (left), chemical hazards ...