This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

The Romans did not use numerals to indicate fractions but instead used words to indicate parts of a whole.

Did you know?

Eating carrots will improve your eyesight. Carrots are high in vitamin A (retinol), which is essential for good vision. It can also be found in milk, cheese, egg yolks, and liver.

Did you know?

Asthma cases in Americans are about 75% higher today than they were in 1980.

Did you know?

Ether was used widely for surgeries but became less popular because of its flammability and its tendency to cause vomiting. In England, it was quickly replaced by chloroform, but this agent caused many deaths and lost popularity.

Did you know?

Blood in the urine can be a sign of a kidney stone, glomerulonephritis, or other kidney problems.

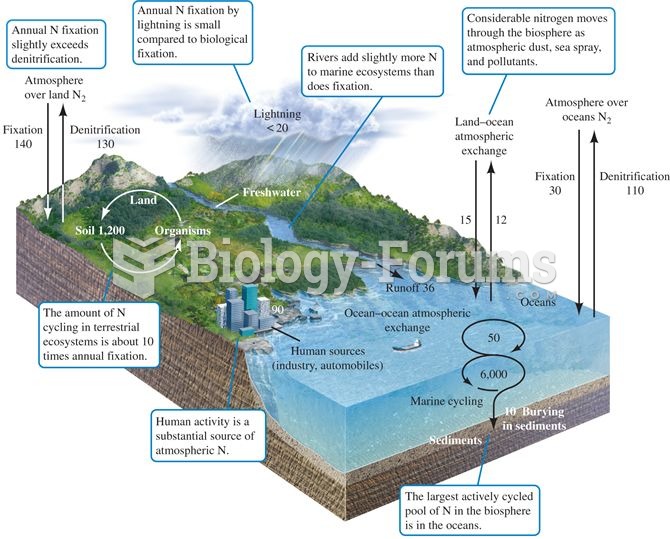

The nitrogen cycle. Numbers represent fluxes as 1012 g N per year (data from Schlesinger 1991, after

The nitrogen cycle. Numbers represent fluxes as 1012 g N per year (data from Schlesinger 1991, after

Reindeer antlers grow again each year under a layer of fur called velvet. This reindeer is losing th

Reindeer antlers grow again each year under a layer of fur called velvet. This reindeer is losing th