This topic contains a solution. Click here to go to the answer

|

|

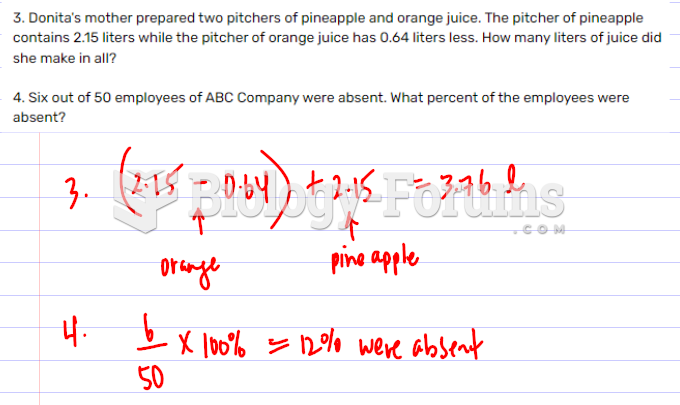

|

Did you know?

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.

Did you know?

The U.S. Preventive Services Task Force recommends that all women age 65 years of age or older should be screened with bone densitometry.

Did you know?

If all the neurons in the human body were lined up, they would stretch more than 600 miles.

Did you know?

Stroke kills people from all ethnic backgrounds, but the people at highest risk for fatal strokes are: black men, black women, Asian men, white men, and white women.

Did you know?

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.