This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

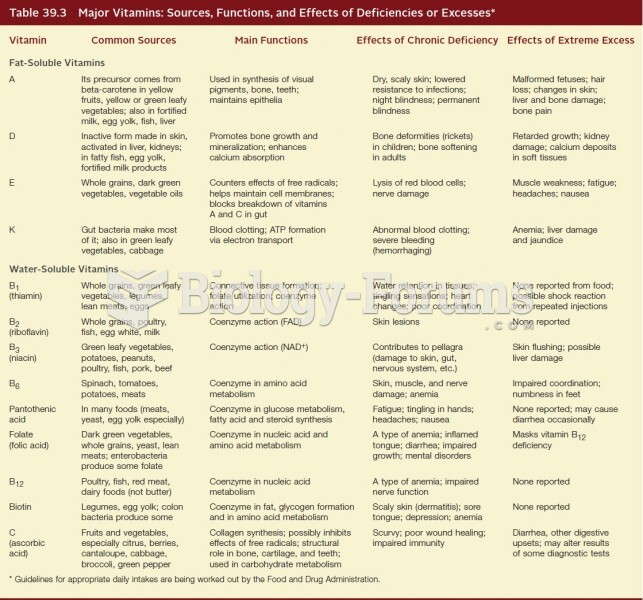

Eating carrots will improve your eyesight. Carrots are high in vitamin A (retinol), which is essential for good vision. It can also be found in milk, cheese, egg yolks, and liver.

Did you know?

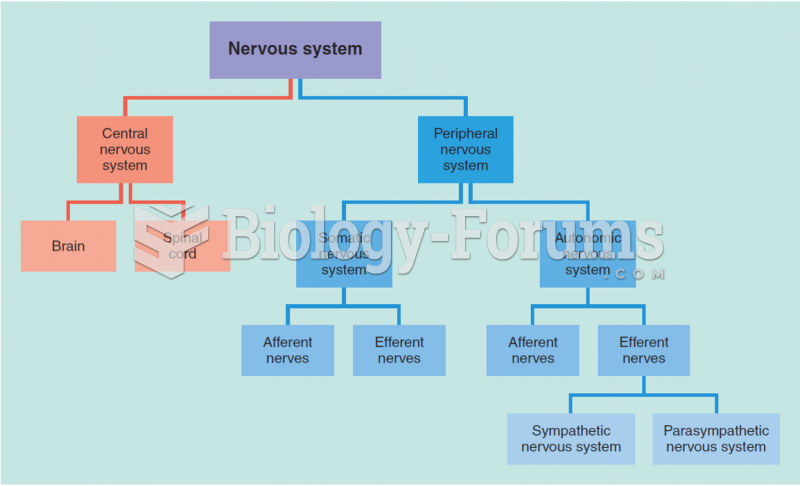

Multiple sclerosis is a condition wherein the body's nervous system is weakened by an autoimmune reaction that attacks the myelin sheaths of neurons.

Did you know?

More than 4.4billion prescriptions were dispensed within the United States in 2016.

Did you know?

Cytomegalovirus affects nearly the same amount of newborns every year as Down syndrome.

Did you know?

After 5 years of being diagnosed with rheumatoid arthritis, one every three patients will no longer be able to work.