|

|

|

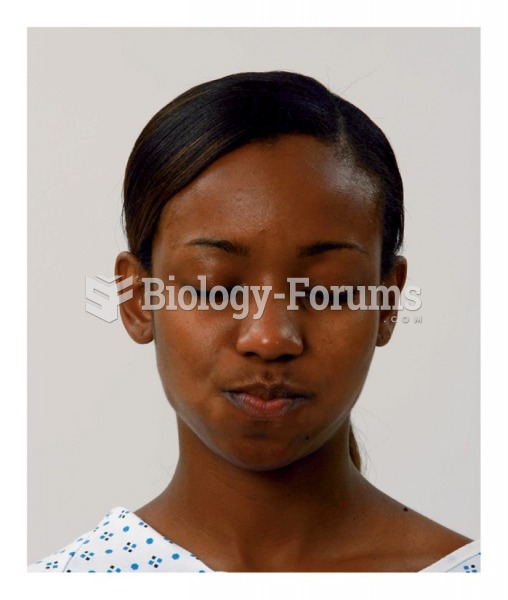

Stevens-Johnson syndrome and Toxic Epidermal Necrolysis syndrome are life-threatening reactions that can result in death. Complications include permanent blindness, dry-eye syndrome, lung damage, photophobia, asthma, chronic obstructive pulmonary disease, permanent loss of nail beds, scarring of mucous membranes, arthritis, and chronic fatigue syndrome. Many patients' pores scar shut, causing them to retain heat.

Hippocrates noted that blood separates into four differently colored liquids when removed from the body and examined: a pure red liquid mixed with white liquid material with a yellow-colored froth at the top and a black substance that settles underneath; he named these the four humors (for blood, phlegm, yellow bile, and black bile).

When blood is exposed to air, it clots. Heparin allows the blood to come in direct contact with air without clotting.

Nearly 31 million adults in America have a total cholesterol level that is more than 240 mg per dL.

Cucumber slices relieve headaches by tightening blood vessels, reducing blood flow to the area, and relieving pressure.