|

|

|

Your heart beats over 36 million times a year.

There are more nerve cells in one human brain than there are stars in the Milky Way.

Giardia is one of the most common intestinal parasites worldwide, and infects up to 20% of the world population, mostly in poorer countries with inadequate sanitation. Infections are most common in children, though chronic Giardia is more common in adults.

Bisphosphonates were first developed in the nineteenth century. They were first investigated for use in disorders of bone metabolism in the 1960s. They are now used clinically for the treatment of osteoporosis, Paget's disease, bone metastasis, multiple myeloma, and other conditions that feature bone fragility.

Blastomycosis is often misdiagnosed, resulting in tragic outcomes. It is caused by a fungus living in moist soil, in wooded areas of the United States and Canada. If inhaled, the fungus can cause mild breathing problems that may worsen and cause serious illness and even death.

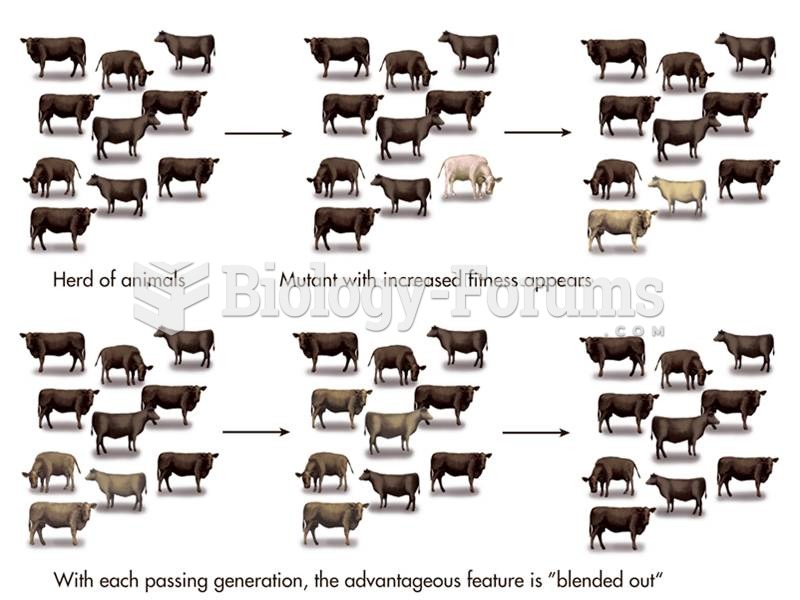

Blending inheritance formed the basis of nineteenth-century critiques of evolution by natural select

Blending inheritance formed the basis of nineteenth-century critiques of evolution by natural select

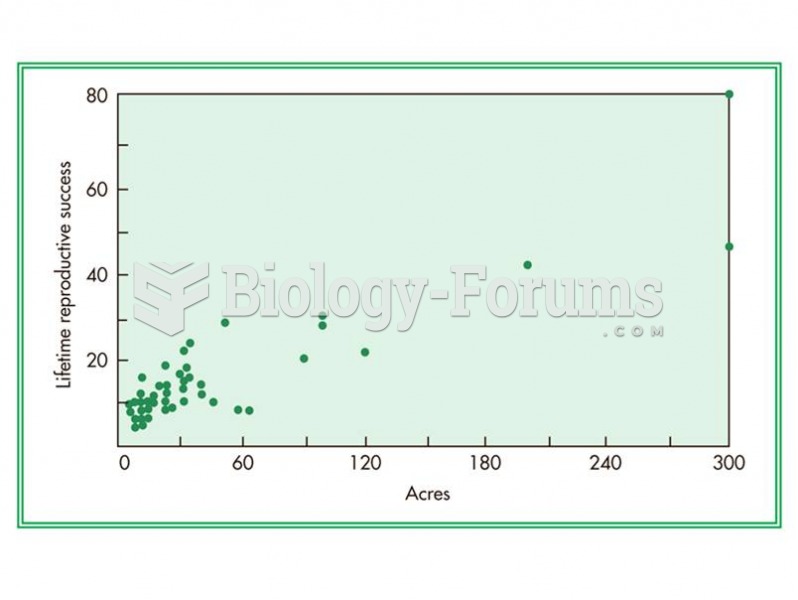

The relationship between number of acres a Kipsigis man owns and the number of offspring he has duri

The relationship between number of acres a Kipsigis man owns and the number of offspring he has duri