|

|

|

According to the FDA, adverse drug events harmed or killed approximately 1,200,000 people in the United States in the year 2015.

Cutaneous mucormycosis is a rare fungal infection that has been fatal in at least 29% of cases, and in as many as 83% of cases, depending on the patient's health prior to infection. It has occurred often after natural disasters such as tornados, and early treatment is essential.

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.

For about 100 years, scientists thought that peptic ulcers were caused by stress, spicy food, and alcohol. Later, researchers added stomach acid to the list of causes and began treating ulcers with antacids. Now it is known that peptic ulcers are predominantly caused by Helicobacter pylori, a spiral-shaped bacterium that normally exist in the stomach.

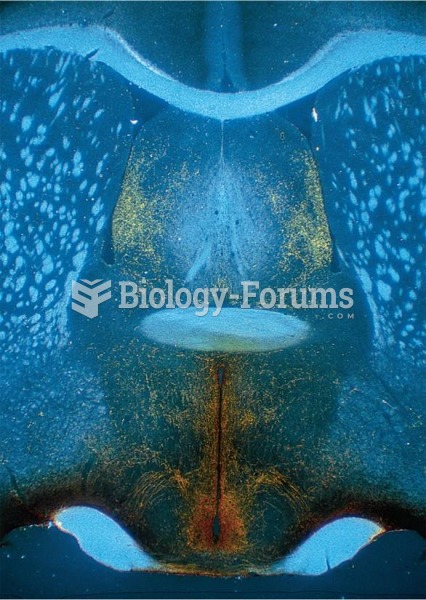

Localization of a Peptide The peptide is revealed by means of immunocytochemistry. The photomicrogra

Localization of a Peptide The peptide is revealed by means of immunocytochemistry. The photomicrogra

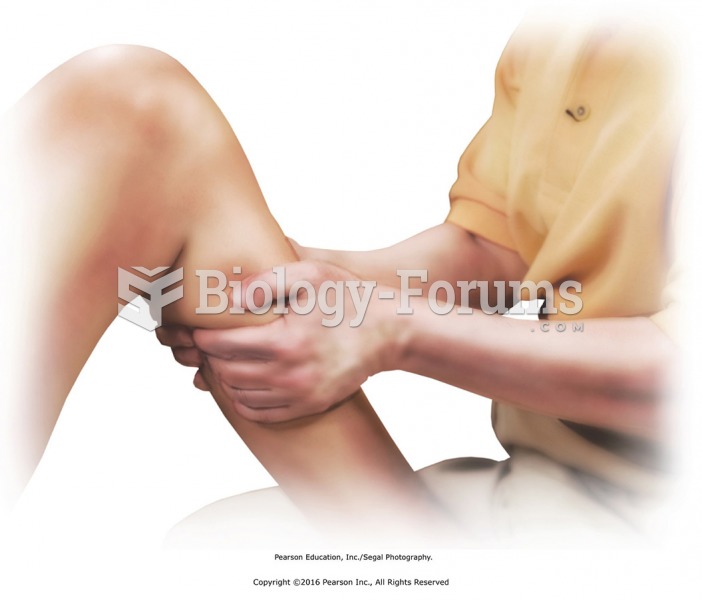

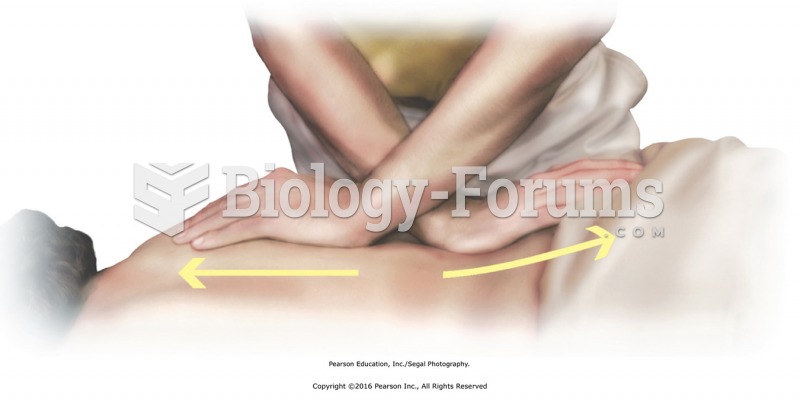

Stand facing the side of the table and apply cross-handed stretches for the subcutaneous fascia. ...

Stand facing the side of the table and apply cross-handed stretches for the subcutaneous fascia. ...