This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

The U.S. Pharmacopeia Medication Errors Reporting Program states that approximately 50% of all medication errors involve insulin.

Did you know?

About 100 new prescription or over-the-counter drugs come into the U.S. market every year.

Did you know?

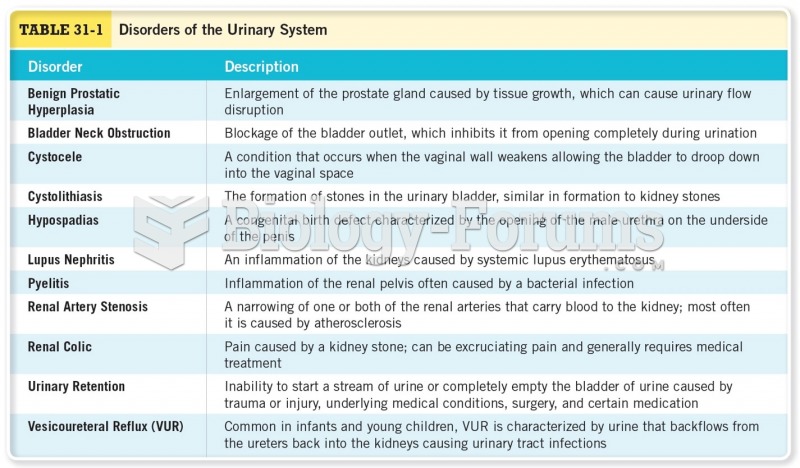

In most climates, 8 to 10 glasses of water per day is recommended for adults. The best indicator for adequate fluid intake is frequent, clear urination.

Did you know?

There are over 65,000 known species of protozoa. About 10,000 species are parasitic.

Did you know?

More than 150,000 Americans killed by cardiovascular disease are younger than the age of 65 years.