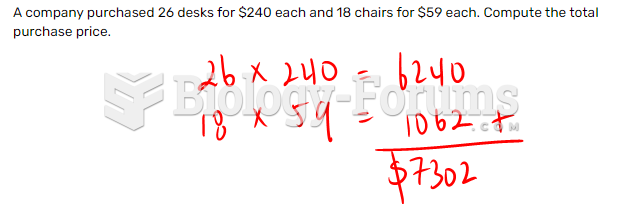

This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Approximately 500,000 babies are born each year in the United States to teenage mothers.

Did you know?

Alcohol acts as a diuretic. Eight ounces of water is needed to metabolize just 1 ounce of alcohol.

Did you know?

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Did you know?

After 5 years of being diagnosed with rheumatoid arthritis, one every three patients will no longer be able to work.

Did you know?

In ancient Rome, many of the richer people in the population had lead-induced gout. The reason for this is unclear. Lead poisoning has also been linked to madness.