This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

You should not take more than 1,000 mg of vitamin E per day. Doses above this amount increase the risk of bleeding problems that can lead to a stroke.

Did you know?

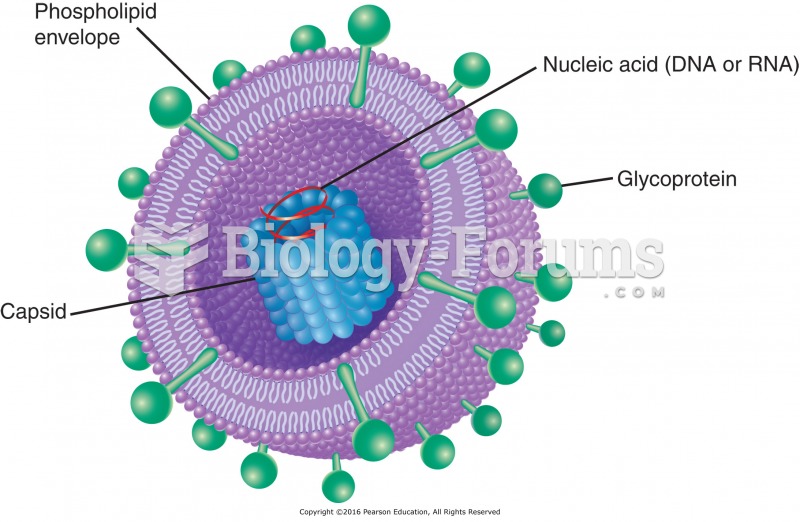

A seasonal flu vaccine is the best way to reduce the chances you will get seasonal influenza and spread it to others.

Did you know?

About 100 new prescription or over-the-counter drugs come into the U.S. market every year.

Did you know?

Today, nearly 8 out of 10 pregnant women living with HIV (about 1.1 million), receive antiretrovirals.

Did you know?

More than 34,000 trademarked medication names and more than 10,000 generic medication names are in use in the United States.