|

|

|

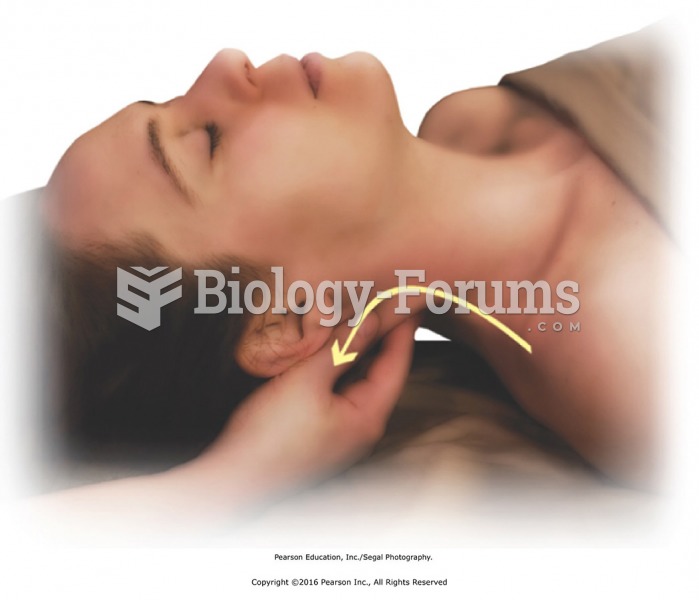

For high blood pressure (hypertension), a new class of drug, called a vasopeptidase blocker (inhibitor), has been developed. It decreases blood pressure by simultaneously dilating the peripheral arteries and increasing the body's loss of salt.

When taking monoamine oxidase inhibitors, people should avoid a variety of foods, which include alcoholic beverages, bean curd, broad (fava) bean pods, cheese, fish, ginseng, protein extracts, meat, sauerkraut, shrimp paste, soups, and yeast.

About 60% of newborn infants in the United States are jaundiced; that is, they look yellow. Kernicterus is a form of brain damage caused by excessive jaundice. When babies begin to be affected by excessive jaundice and begin to have brain damage, they become excessively lethargic.

Bacteria have been found alive in a lake buried one half mile under ice in Antarctica.

Fungal nail infections account for up to 30% of all skin infections. They affect 5% of the general population—mostly people over the age of 70.