|

|

|

Approximately 500,000 babies are born each year in the United States to teenage mothers.

Anesthesia awareness is a potentially disturbing adverse effect wherein patients who have been paralyzed with muscle relaxants may awaken. They may be aware of their surroundings but unable to communicate or move. Neurologic monitoring equipment that helps to more closely check the patient's anesthesia stages is now available to avoid the occurrence of anesthesia awareness.

Cocaine was isolated in 1860 and first used as a local anesthetic in 1884. Its first clinical use was by Sigmund Freud to wean a patient from morphine addiction. The fictional character Sherlock Holmes was supposed to be addicted to cocaine by injection.

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Automated pill dispensing systems have alarms to alert patients when the correct dosing time has arrived. Most systems work with many varieties of medications, so patients who are taking a variety of drugs can still be in control of their dose regimen.

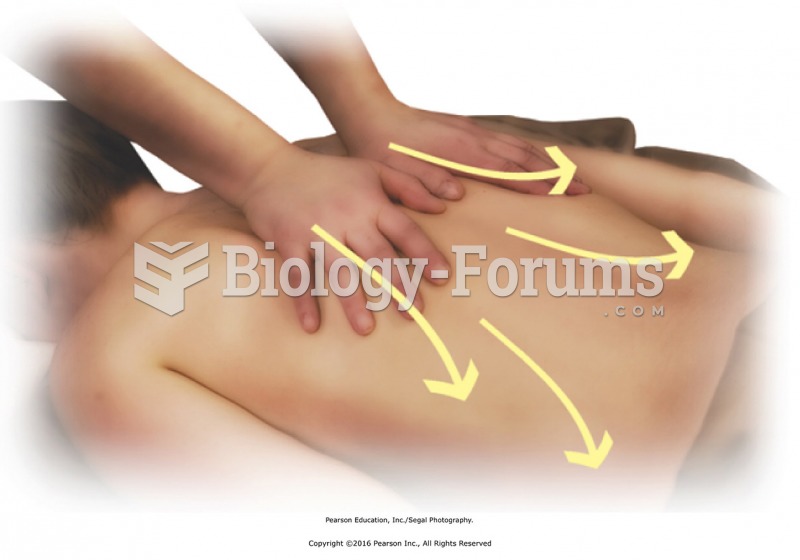

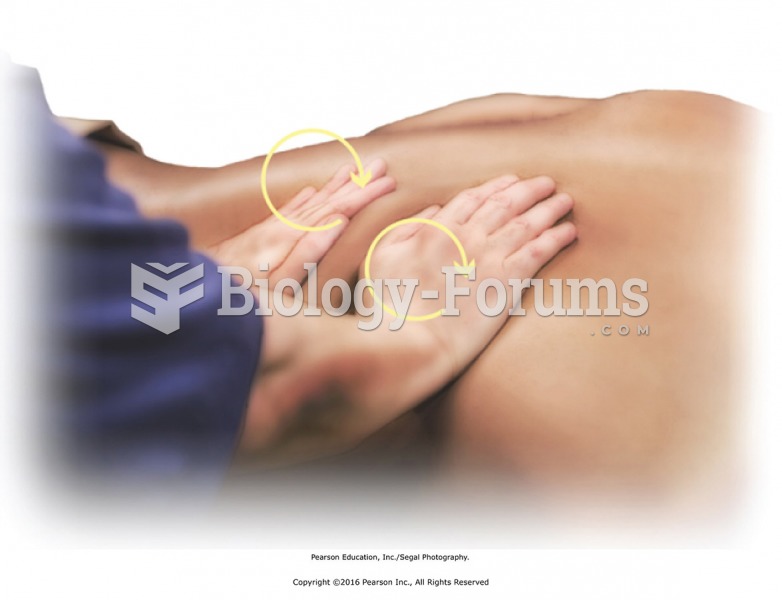

Starting at the waist, apply circular two-handed petrissage over the entire right side. Keep hands ...

Starting at the waist, apply circular two-handed petrissage over the entire right side. Keep hands ...

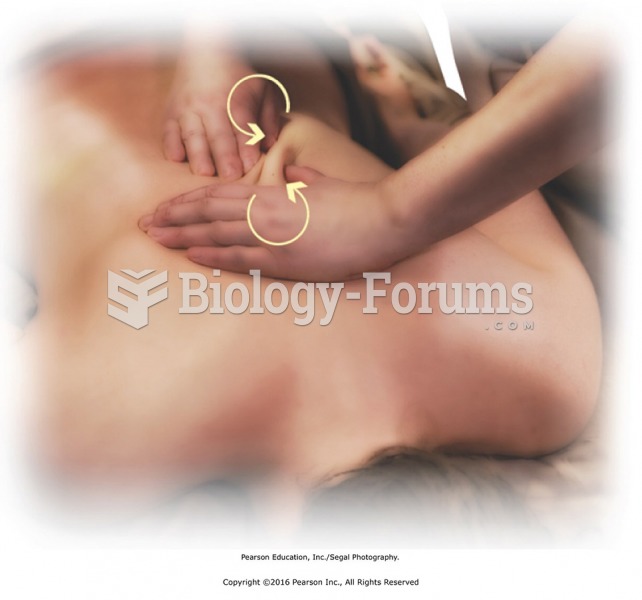

Apply two-hand petrissage over the entire upper back. Place palms flat on back next to each other. ...

Apply two-hand petrissage over the entire upper back. Place palms flat on back next to each other. ...