|

|

|

Despite claims by manufacturers, the supplement known as Ginkgo biloba was shown in a study of more than 3,000 participants to be ineffective in reducing development of dementia and Alzheimer’s disease in older people.

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.

The Centers for Disease Control and Prevention has released reports detailing the deaths of infants (younger than 1 year of age) who died after being given cold and cough medications. This underscores the importance of educating parents that children younger than 2 years of age should never be given over-the-counter cold and cough medications without consulting their physicians.

In ancient Rome, many of the richer people in the population had lead-induced gout. The reason for this is unclear. Lead poisoning has also been linked to madness.

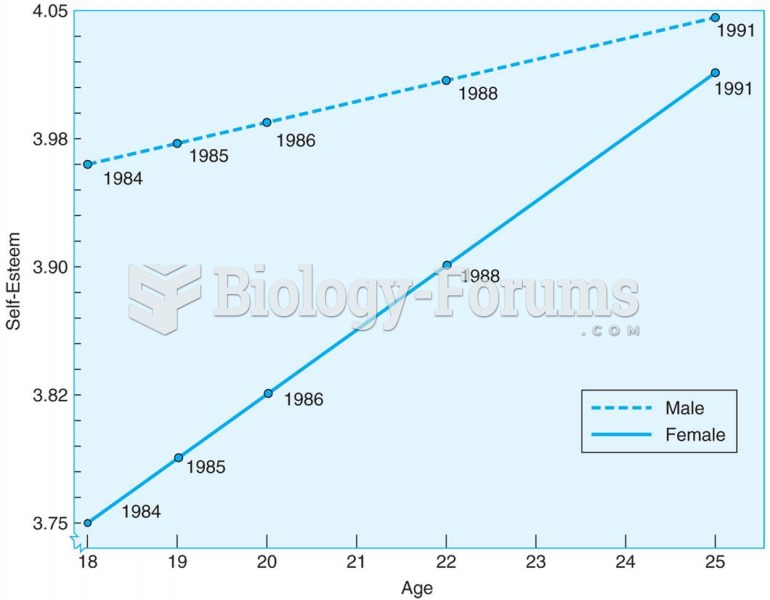

Young adults increase in self-esteem between the ages of 18 and 25, according to this longitudinal s

Young adults increase in self-esteem between the ages of 18 and 25, according to this longitudinal s

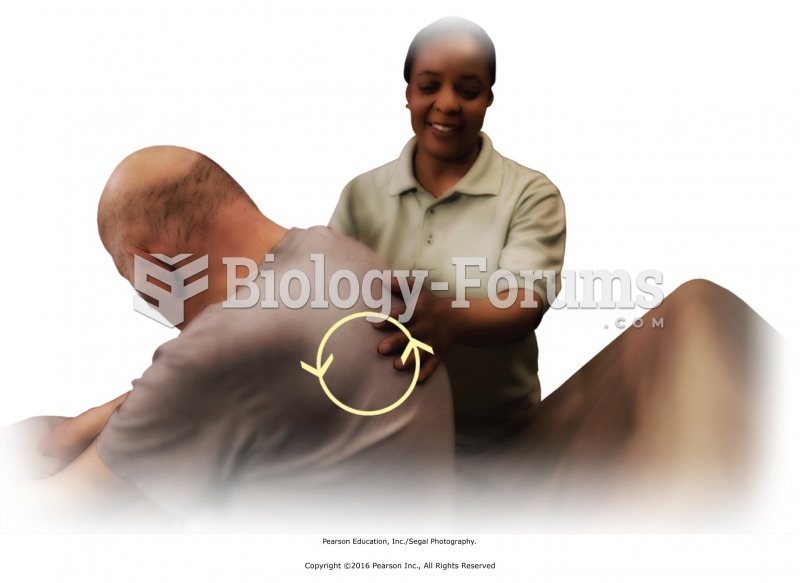

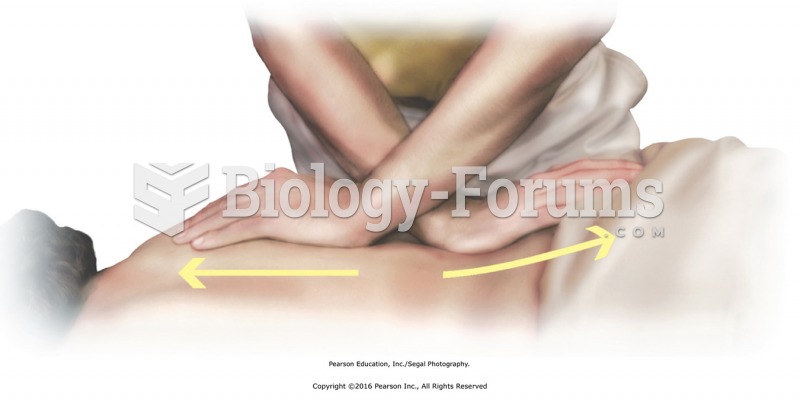

Stand facing the side of the table and apply cross-handed stretches for the subcutaneous fascia. ...

Stand facing the side of the table and apply cross-handed stretches for the subcutaneous fascia. ...