|

|

|

Every 10 seconds, a person in the United States goes to the emergency room complaining of head pain. About 1.2 million visits are for acute migraine attacks.

The first-known contraceptive was crocodile dung, used in Egypt in 2000 BC. Condoms were also reportedly used, made of animal bladders or intestines.

Sildenafil (Viagra®) has two actions that may be of consequence in patients with heart disease. It can lower the blood pressure, and it can interact with nitrates. It should never be used in patients who are taking nitrates.

Thyroid conditions cause a higher risk of fibromyalgia and chronic fatigue syndrome.

Hippocrates noted that blood separates into four differently colored liquids when removed from the body and examined: a pure red liquid mixed with white liquid material with a yellow-colored froth at the top and a black substance that settles underneath; he named these the four humors (for blood, phlegm, yellow bile, and black bile).

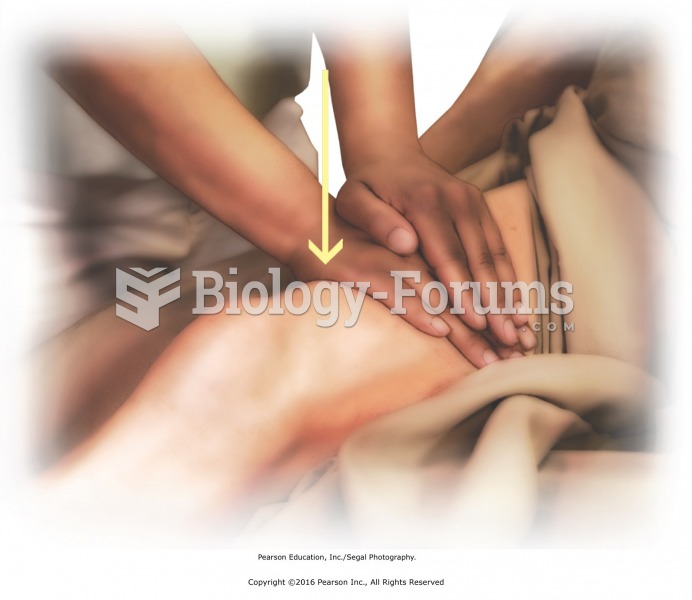

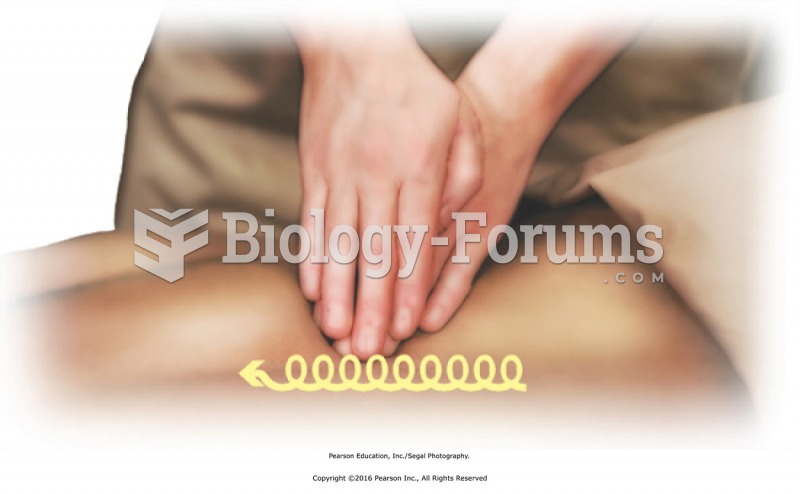

Apply deep circular friction with the fingertips to the erector muscles on the right side, moving ...

Apply deep circular friction with the fingertips to the erector muscles on the right side, moving ...

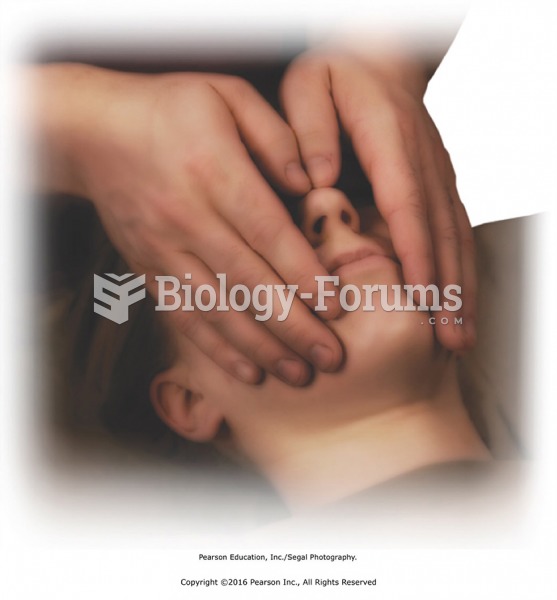

Apply passive touch over the eyes and cheeks to finish. Place the hands, using very light pressure, ...

Apply passive touch over the eyes and cheeks to finish. Place the hands, using very light pressure, ...