|

|

|

A recent study has found that following a diet rich in berries may slow down the aging process of the brain. This diet apparently helps to keep dopamine levels much higher than are seen in normal individuals who do not eat berries as a regular part of their diet as they enter their later years.

Although the Roman numeral for the number 4 has always been taught to have been "IV," according to historians, the ancient Romans probably used "IIII" most of the time. This is partially backed up by the fact that early grandfather clocks displayed IIII for the number 4 instead of IV. Early clockmakers apparently thought that the IIII balanced out the VIII (used for the number 8) on the clock face and that it just looked better.

Cytomegalovirus affects nearly the same amount of newborns every year as Down syndrome.

Prostaglandins were first isolated from human semen in Sweden in the 1930s. They were so named because the researcher thought that they came from the prostate gland. In fact, prostaglandins exist and are synthesized in almost every cell of the body.

The first war in which wide-scale use of anesthetics occurred was the Civil War, and 80% of all wounds were in the extremities.

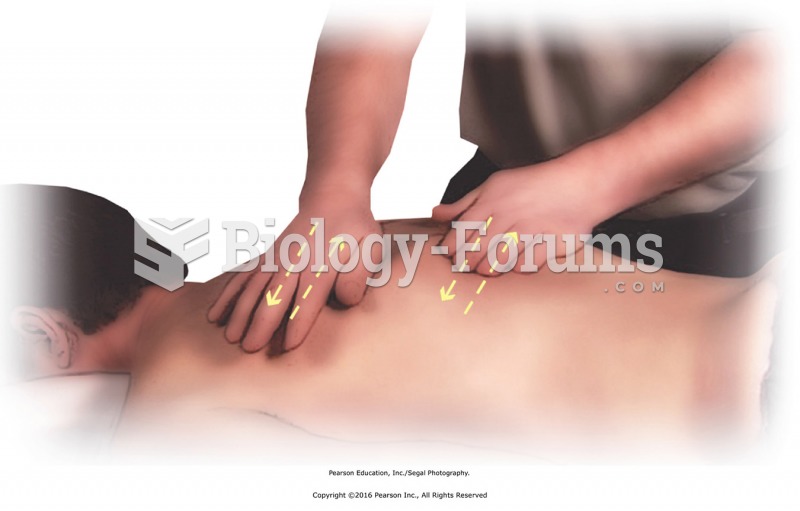

Apply deep circular friction with the fingertips to the erector muscles on the right side, moving ...

Apply deep circular friction with the fingertips to the erector muscles on the right side, moving ...

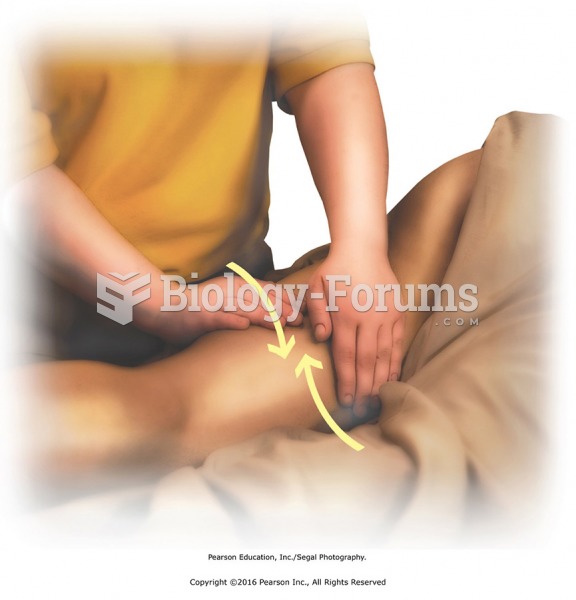

Use of the elbow to apply pressure to trigger points in the trapezius with the receiver in sitting ...

Use of the elbow to apply pressure to trigger points in the trapezius with the receiver in sitting ...