|

|

|

Did you know?

According to animal studies, the typical American diet is damaging to the liver and may result in allergies, low energy, digestive problems, and a lack of ability to detoxify harmful substances.

Did you know?

The B-complex vitamins and vitamin C are not stored in the body and must be replaced each day.

Did you know?

Most women experience menopause in their 50s. However, in 1994, an Italian woman gave birth to a baby boy when she was 61 years old.

Did you know?

More than 4.4billion prescriptions were dispensed within the United States in 2016.

Did you know?

Medication errors are more common among seriously ill patients than with those with minor conditions.

The air pressure going to the nozzle should be reduced to 30 psi or less to help prevent personal ...

The air pressure going to the nozzle should be reduced to 30 psi or less to help prevent personal ...

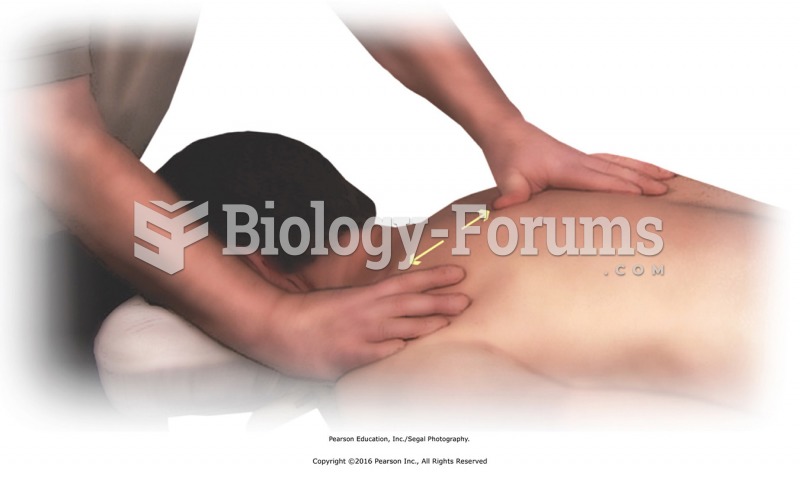

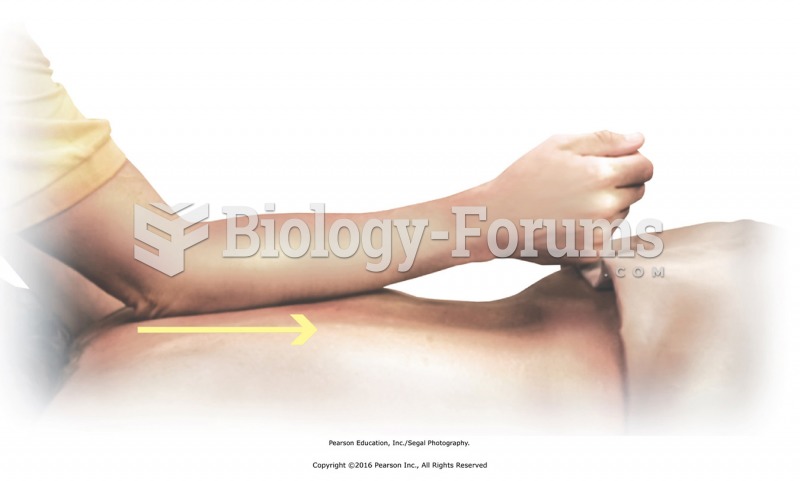

Apply forearm to the deep fascia of the back. Stand to one side of the face cradle; use the proximal ...

Apply forearm to the deep fascia of the back. Stand to one side of the face cradle; use the proximal ...

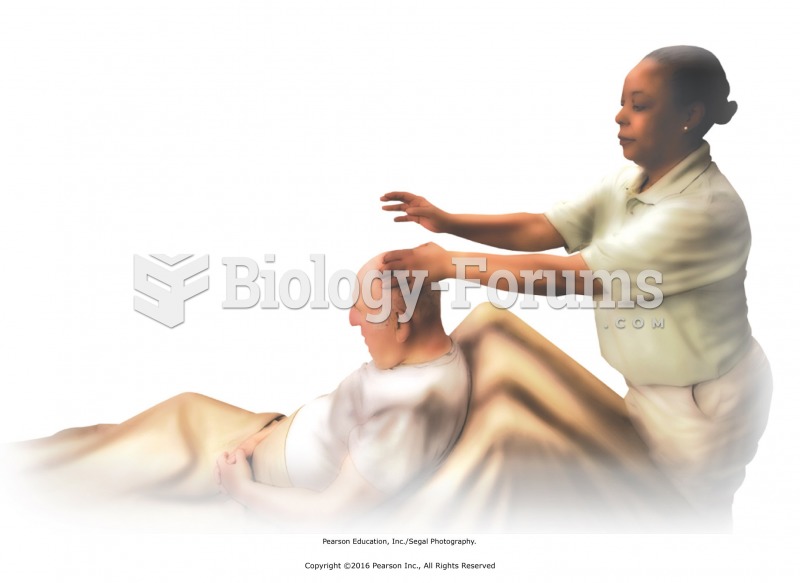

Apply light tapotement on the head. Tapping lightly with the fingertips works well for this purpose.

Apply light tapotement on the head. Tapping lightly with the fingertips works well for this purpose.