|

|

|

If you use artificial sweeteners, such as cyclamates, your eyes may be more sensitive to light. Other factors that will make your eyes more sensitive to light include use of antibiotics, oral contraceptives, hypertension medications, diuretics, and antidiabetic medications.

Bacteria have been found alive in a lake buried one half mile under ice in Antarctica.

Thyroid conditions may make getting pregnant impossible.

According to the American College of Allergy, Asthma & Immunology, more than 50 million Americans have some kind of food allergy. Food allergies affect between 4 and 6% of children, and 4% of adults, according to the CDC. The most common food allergies include shellfish, peanuts, walnuts, fish, eggs, milk, and soy.

GI conditions that will keep you out of the U.S. armed services include ulcers, varices, fistulas, esophagitis, gastritis, congenital abnormalities, inflammatory bowel disease, enteritis, colitis, proctitis, duodenal diverticula, malabsorption syndromes, hepatitis, cirrhosis, cysts, abscesses, pancreatitis, polyps, certain hemorrhoids, splenomegaly, hernias, recent abdominal surgery, GI bypass or stomach stapling, and artificial GI openings.

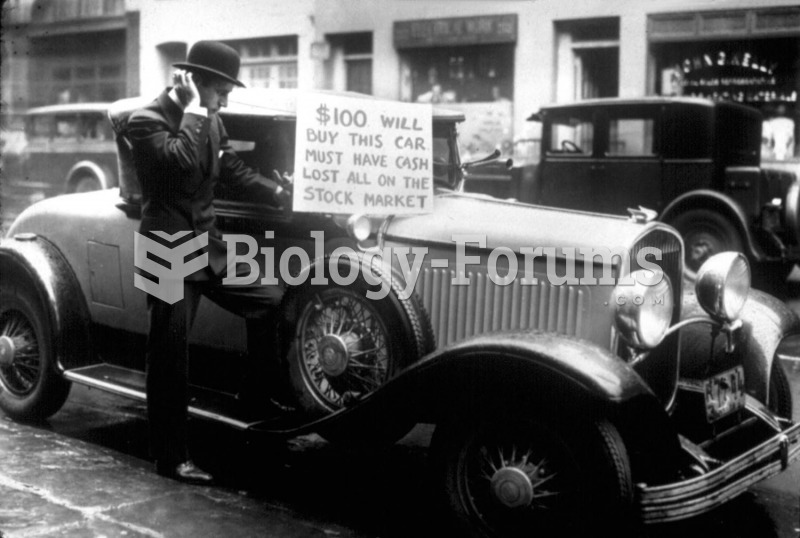

Walter Thompson saw his assets evaporate during the stock market collapse in 1929. Desperate for ...

Walter Thompson saw his assets evaporate during the stock market collapse in 1929. Desperate for ...

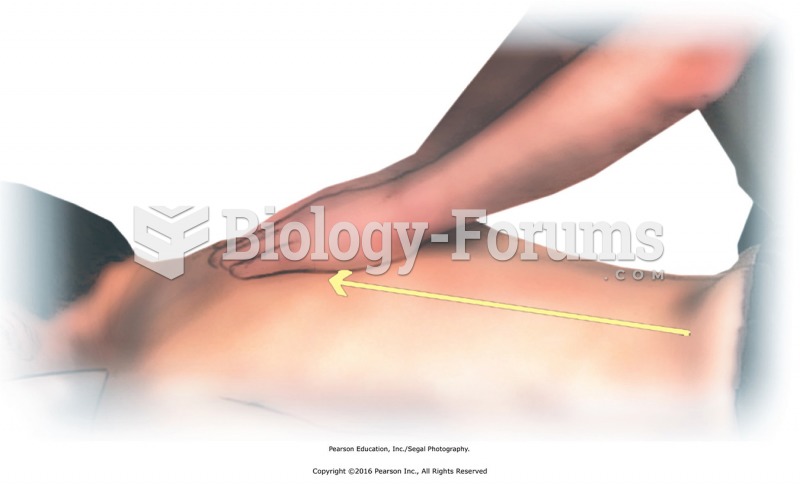

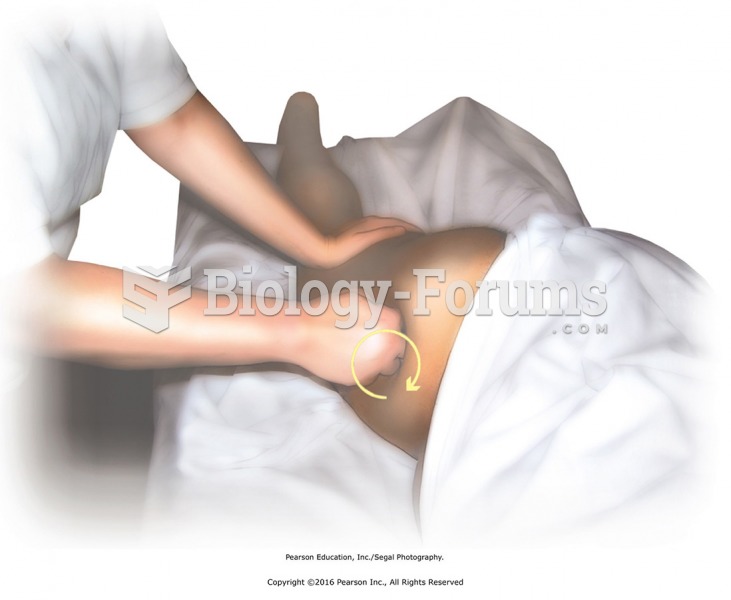

Deep friction around the hip joint using the knuckles. Use the knuckle of the middle finger to apply ...

Deep friction around the hip joint using the knuckles. Use the knuckle of the middle finger to apply ...