|

|

|

According to the Migraine Research Foundation, migraines are the third most prevalent illness in the world. Women are most affected (18%), followed by children of both sexes (10%), and men (6%).

Only one in 10 cancer deaths is caused by the primary tumor. The vast majority of cancer mortality is caused by cells breaking away from the main tumor and metastasizing to other parts of the body, such as the brain, bones, or liver.

There can actually be a 25-hour time difference between certain locations in the world. The International Date Line passes between the islands of Samoa and American Samoa. It is not a straight line, but "zig-zags" around various island chains. Therefore, Samoa and nearby islands have one date, while American Samoa and nearby islands are one day behind. Daylight saving time is used in some islands, but not in others—further shifting the hours out of sync with natural time.

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

Today, nearly 8 out of 10 pregnant women living with HIV (about 1.1 million), receive antiretrovirals.

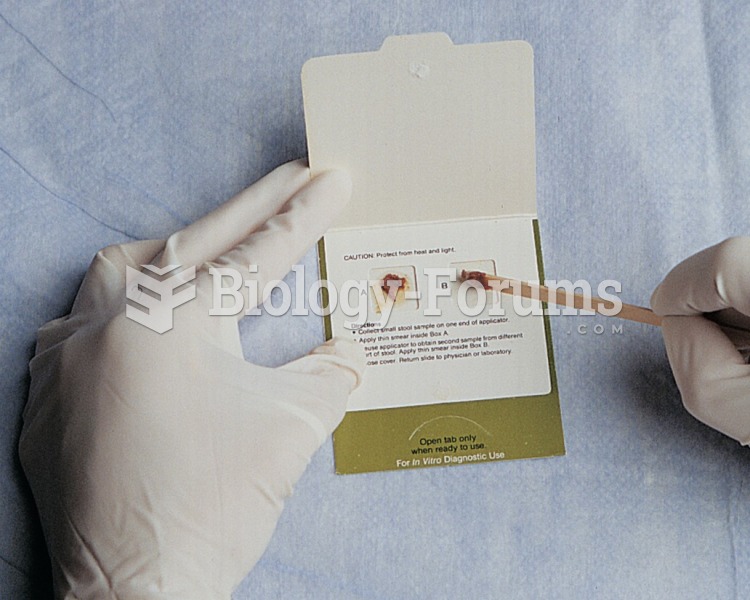

Instruct the patient to use an applicator to apply a small amount of stool in the appropriate boxes ...

Instruct the patient to use an applicator to apply a small amount of stool in the appropriate boxes ...

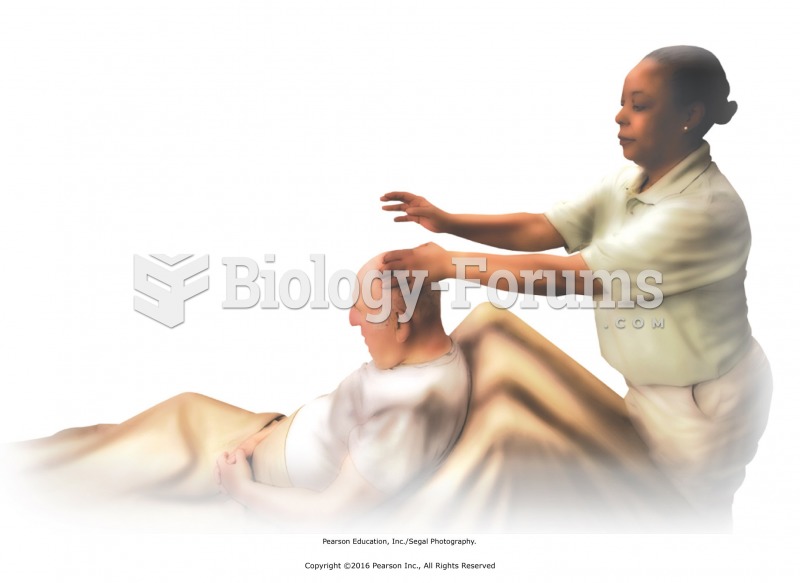

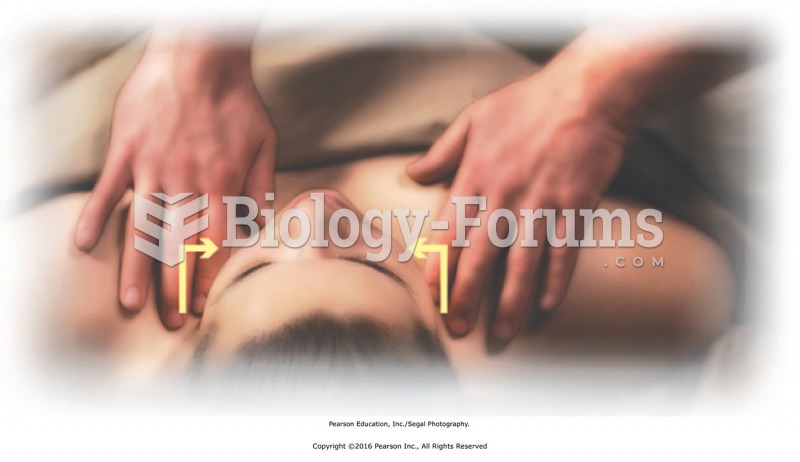

Apply passive touch over abdomen to finish. Slow the circle stroke you performed in Step 14, and let ...

Apply passive touch over abdomen to finish. Slow the circle stroke you performed in Step 14, and let ...