|

|

|

More than 50% of American adults have oral herpes, which is commonly known as "cold sores" or "fever blisters." The herpes virus can be active on the skin surface without showing any signs or causing any symptoms.

The highest suicide rate in the United States is among people ages 65 years and older. Almost 15% of people in this age group commit suicide every year.

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

Asthma-like symptoms were first recorded about 3,500 years ago in Egypt. The first manuscript specifically written about asthma was in the year 1190, describing a condition characterized by sudden breathlessness. The treatments listed in this manuscript include chicken soup, herbs, and sexual abstinence.

Elderly adults are living longer, and causes of death are shifting. At the same time, autopsy rates are at or near their lowest in history.

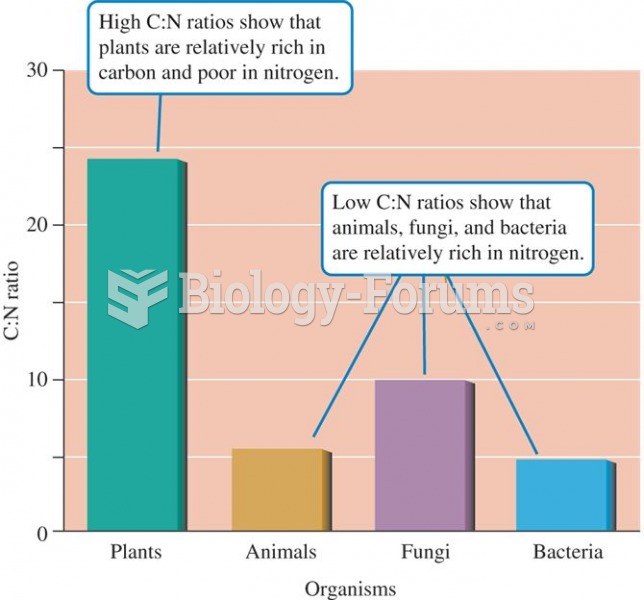

On average, the ratio of carbon to nitrogen is much higher in terrestrial plants than in other major

On average, the ratio of carbon to nitrogen is much higher in terrestrial plants than in other major

Muskox populations remain in the Arctic all year, though they migrate to higher elevations in the wi

Muskox populations remain in the Arctic all year, though they migrate to higher elevations in the wi