|

|

|

Approximately 500,000 babies are born each year in the United States to teenage mothers.

Illicit drug use costs the United States approximately $181 billion every year.

There are major differences in the metabolism of morphine and the illegal drug heroin. Morphine mostly produces its CNS effects through m-receptors, and at k- and d-receptors. Heroin has a slight affinity for opiate receptors. Most of its actions are due to metabolism to active metabolites (6-acetylmorphine, morphine, and morphine-6-glucuronide).

The first monoclonal antibodies were made exclusively from mouse cells. Some are now fully human, which means they are likely to be safer and may be more effective than older monoclonal antibodies.

The Babylonians wrote numbers in a system that used 60 as the base value rather than the number 10. They did not have a symbol for "zero."

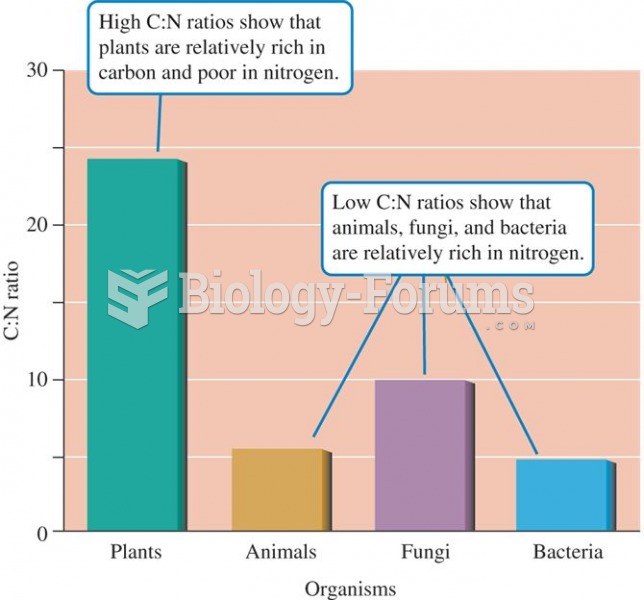

On average, the ratio of carbon to nitrogen is much higher in terrestrial plants than in other major

On average, the ratio of carbon to nitrogen is much higher in terrestrial plants than in other major

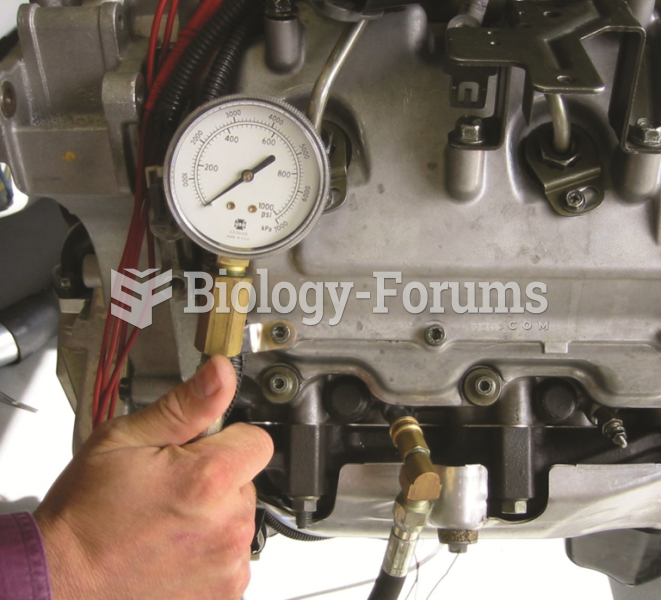

A compression gauge designed for the higher compression rate of a diesel engine should be used when ...

A compression gauge designed for the higher compression rate of a diesel engine should be used when ...