|

|

|

The Centers for Disease Control and Prevention has released reports detailing the deaths of infants (younger than 1 year of age) who died after being given cold and cough medications. This underscores the importance of educating parents that children younger than 2 years of age should never be given over-the-counter cold and cough medications without consulting their physicians.

Always store hazardous household chemicals in their original containers out of reach of children. These include bleach, paint, strippers and products containing turpentine, garden chemicals, oven cleaners, fondue fuels, nail polish, and nail polish remover.

In 1885, the Lloyd Manufacturing Company of Albany, New York, promoted and sold "Cocaine Toothache Drops" at 15 cents per bottle! In 1914, the Harrison Narcotic Act brought the sale and distribution of this drug under federal control.

Allergies play a major part in the health of children. The most prevalent childhood allergies are milk, egg, soy, wheat, peanuts, tree nuts, and seafood.

Coca-Cola originally used coca leaves and caffeine from the African kola nut. It was advertised as a therapeutic agent and "pickerupper." Eventually, its formulation was changed, and the coca leaves were removed because of the effects of regulation on cocaine-related products.

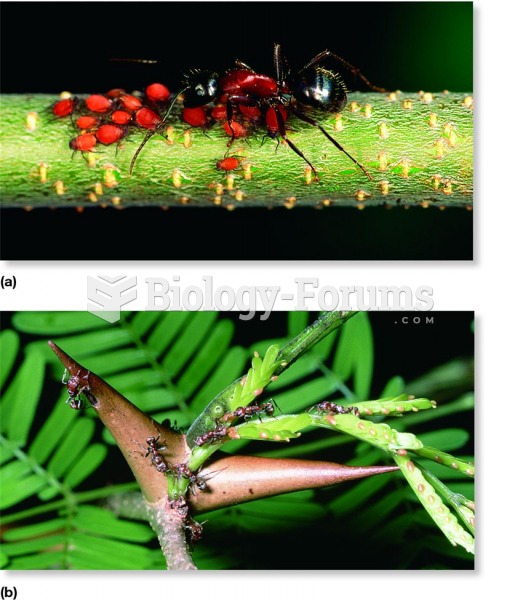

Defensive mutualism involves species that receive food or shelter in return for providing protection

Defensive mutualism involves species that receive food or shelter in return for providing protection

The tarsier is a haplorhine, and may represent an evolutionary bridge between lower and higher prima

The tarsier is a haplorhine, and may represent an evolutionary bridge between lower and higher prima