|

|

|

Only one in 10 cancer deaths is caused by the primary tumor. The vast majority of cancer mortality is caused by cells breaking away from the main tumor and metastasizing to other parts of the body, such as the brain, bones, or liver.

The effects of organophosphate poisoning are referred to by using the abbreviations “SLUD” or “SLUDGE,” It stands for: salivation, lacrimation, urination, defecation, GI upset, and emesis.

Asthma is the most common chronic childhood disease in the world. Most children who develop asthma have symptoms before they are 5 years old.

Signs of depression include feeling sad most of the time for 2 weeks or longer; loss of interest in things normally enjoyed; lack of energy; sleep and appetite disturbances; weight changes; feelings of hopelessness, helplessness, or worthlessness; an inability to make decisions; and thoughts of death and suicide.

Dogs have been used in studies to detect various cancers in human subjects. They have been trained to sniff breath samples from humans that were collected by having them breathe into special tubes. These people included 55 lung cancer patients, 31 breast cancer patients, and 83 cancer-free patients. The dogs detected 54 of the 55 lung cancer patients as having cancer, detected 28 of the 31 breast cancer patients, and gave only three false-positive results (detecting cancer in people who didn't have it).

Muskox populations remain in the Arctic all year, though they migrate to higher elevations in the wi

Muskox populations remain in the Arctic all year, though they migrate to higher elevations in the wi

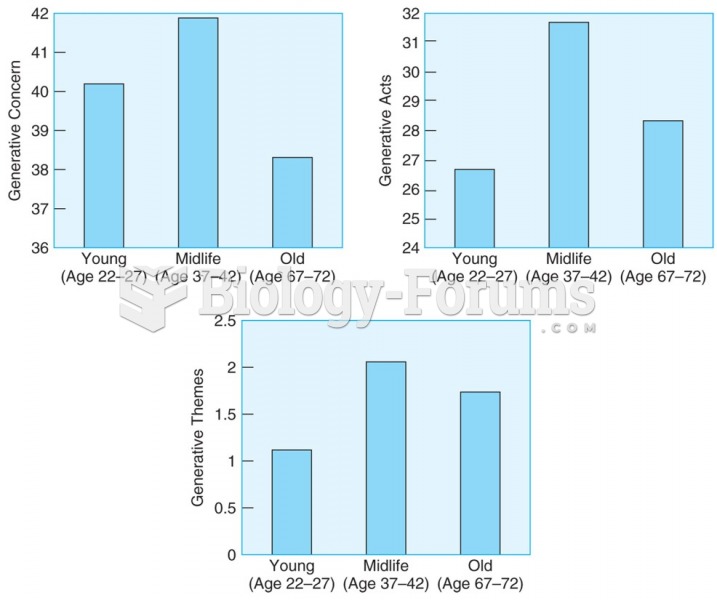

Adults in the middle-aged group (37–42 years) score higher on measures of generativity than either ...

Adults in the middle-aged group (37–42 years) score higher on measures of generativity than either ...